Corporate America may soon be more mindful of director pay. That's good news for shareholders.

To date, it's a topic that's been the subject of a handful of lawsuits and one that's occasionally zeroed in on by activists. But beginning Feb. 1, proxy advisory firm Institutional Shareholder Services is introducing a policy that will draw attention to corporations whose board members are responsible for approving director compensation that is wildly higher than rivals. To draw the ire of ISS, these directors must oversee companies that pay outsize sums to the non-employee members of their boards without "compelling rationale" in consecutive years.

Currently, the median cash-and-stock retainer paid to directors at the largest U.S. companies is $245,000, according to data from Equilar, a compensation analytics firm. That works out to a little under $30,000 per meeting, based on an average of 8.5 meetings per year. But there are folks set to earn far beyond that. At the top of the range are well-paid boards led by Regeneron Pharmaceuticals Inc. and Tesla Inc., with eye-popping individual retainers of $2.1 million and $1.7 million, respectively.

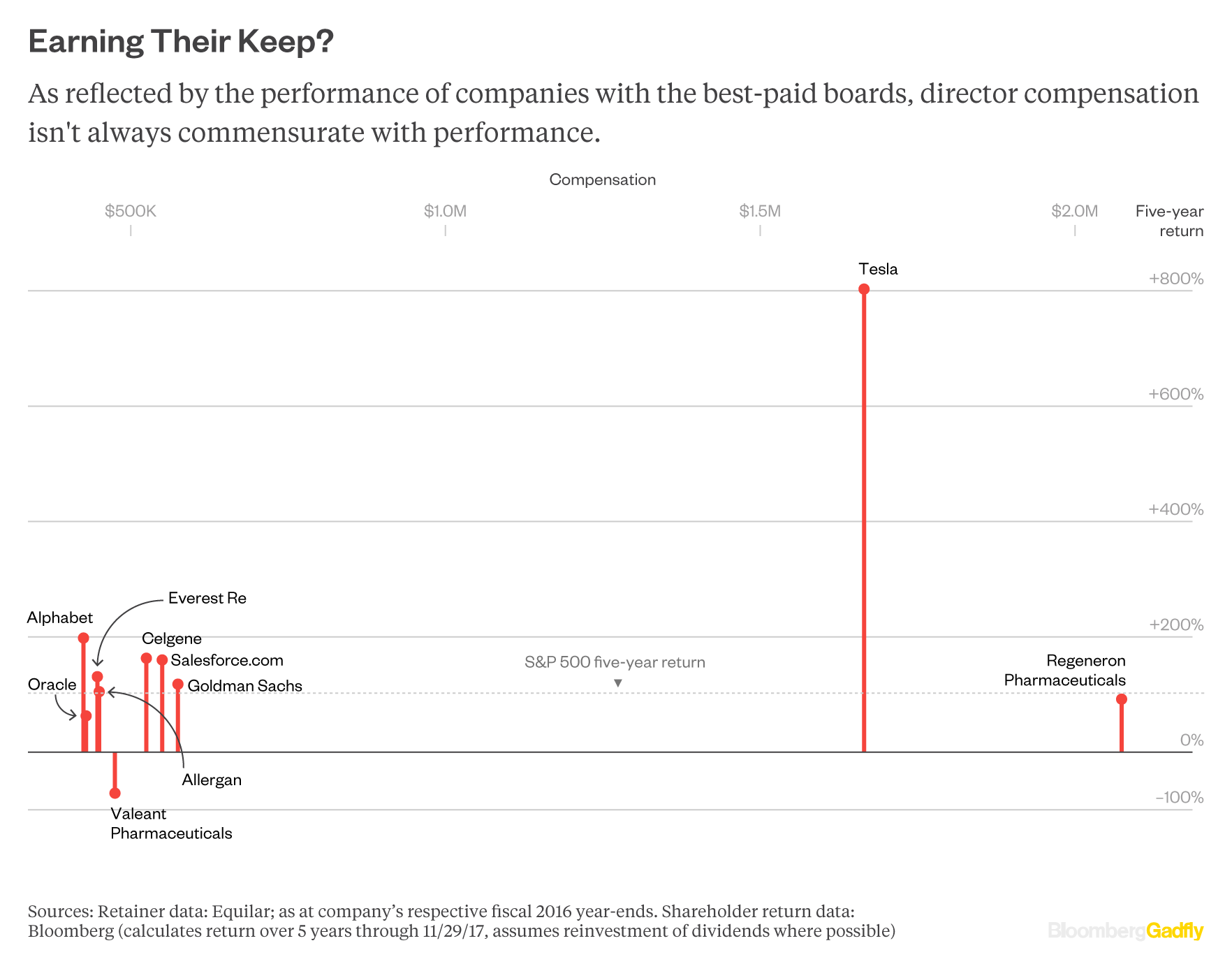

What would be the "compelling rationale" for paying board members so much? Increased profitability and growth under their stewardship, perhaps -- but from an investor's standpoint, share performance is what matters most. By this gauge, the best-paid boards aren't all measuring up.

Tesla's return, to be sure, is almost off this chart -- but that arguably has more to do with investors' broadly unwavering belief in the vision of its founder, Elon Musk, than either its board or the company's financial performance. But with Regeneron, it's a different story.

The biopharmaceutical company's returns in the five years through this week are decent, but they arguably aren't enough to justify its excessive director retainers. And while it's one of many companies that have recently introduced limits for director pay -- something that would seem to be a step in the right direction -- the move was seen by some as a defensive measure designed to fend off lawsuits similar to the one eventually settled by Citrix Systems Inc.

Just setting caps isn't enough to ensure good corporate governance -- they should be also reasonable. Regeneron is yet to show that it understands this. Based on its $39 billion valuation, which my colleague Max Nisen has deemed lofty despite its recent decline, the company's limits on 2018 director pay remain incredibly generous.

Cash Cows

Regeneron's director pay is among the most lofty of any U.S. corporate. Still, a redeeming factor is its heavy stock composition which is designed to align the board with shareholders.

Source: Equilar, company filings

For context, at close to $4.7 million, its director pay limit is more than triple that of Alphabet Inc. ($1.5 million) and more than six times that of Morgan Stanley ($750,000), two companies that dwarf Regeneron in size and returns. Shareholders are also arguably worse off because Regeneron has 13 directors, above the S&P 500's median board size of 11.

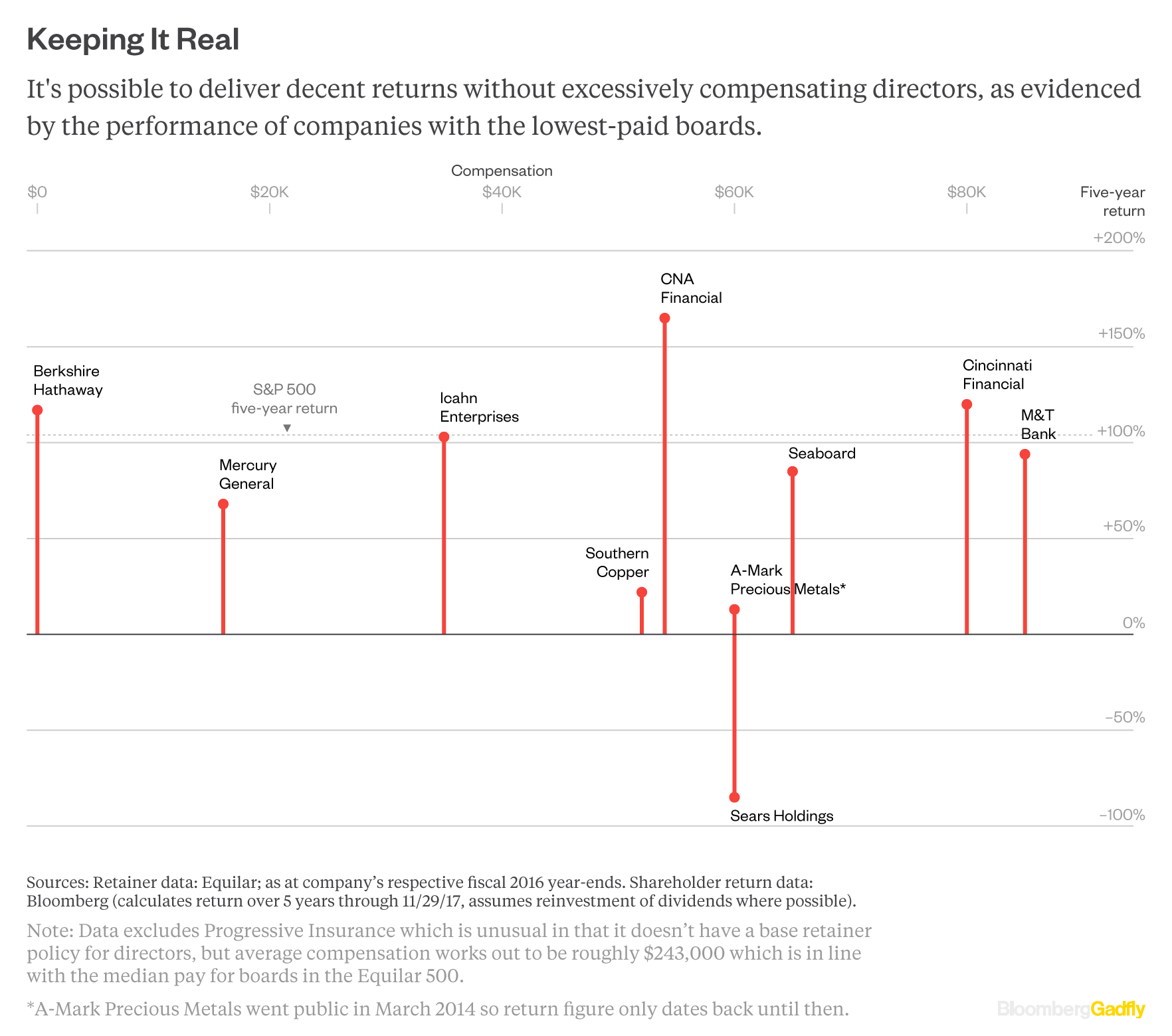

There are companies that show it's possible for board compensation to be modest without sacrificing returns. Leading the way is Warren Buffett's Berkshire Hathaway Inc., whose 10 independent directors aren't even guaranteed a retainer. Rather, they earn small fees for the meetings they attend in person or over the phone, as well as an additional nominal fee for sitting on the audit committee. On an average and median basis, that totals just $3,780 and $2,700, respectively over an entire year -- and no, those aren't typos.

As Buffett's righthand man Charlie Munger has said:

You start paying directors of corporations two or three hundred thousand dollars a year, it creates a daisy chain of reciprocity where they keep raising the [pay of the] CEO and he keeps recommending more pay for the directors.

He has a point: Exorbitant compensation can have ramifications, especially when directors come to rely on fees to make a living. Rather than acting in the best interests of shareholders by, for example, exploring a sale, they may be incentivized to hang on to their roles. Or they may be more reluctant to make changes to management to facilitate necessary strategic activity.

Truancy Pays

Despite rich pay packages, certain directors still fail to attend at least 75 percent of board and committee meetings. That figure has declined substantially since the early 2000s.

Source: Institutional Shareholder Services

Companies that are overpaying their directors relative to sector or index peers should consider addressing this proactively. If not, they'll simply be delaying the inevitable. Increasing scrutiny and an easier path for shareholders to force change suggest that excessive board compensation packages will come down one way or another.

--With graphics assistance from Christopher Cannon

This column does not necessarily reflect the opinion of Bloomberg LP and its owners.

To contact the editor responsible for this story:

Beth Williams at bewilliams@bloomberg.net

Bagikan Berita Ini

0 Response to "Tesla Is the Exception That Proves the Rule on Board Pay"

Post a Comment