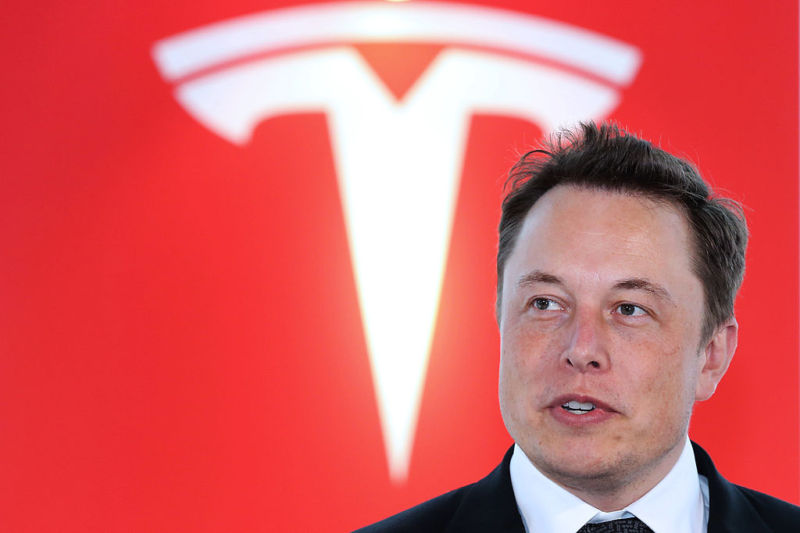

Two powerful advisory firms have both come out against the generous performance-based pay package Tesla announced for CEO Elon Musk back in January. While Glass Lewis and Institutional Shareholder Services are not household names among the general public, their opinion carries a lot of weight among institutional shareholders who may ultimately decide whether Musk's pay package gets approved in a March 21 shareholder vote.

The package “locks in unprecedented high pay opportunities for the next decade, and seemingly limits the board’s ability to meaningfully adjust future pay levels in the event of unforeseen events or changes in either performance or strategic focus,” ISS said in a Thursday statement.

If Tesla's stock value never rises above $100 billion (right now it's around $55 billion), Musk would receive no compensation for running Tesla over the next 10 years. On the other hand, if Tesla stock reaches a value of $100 billion—and the company either earns $1.5 billion in profits or generates revenues of $20 billion—Musk would get one percent of the company's stock, an award worth $1 billion.

Musk would get additional grants of one percent of the company's stock at each $50 billion increment, assuming he continues hitting revenue and profit targets. If Tesla's stock rose to $650 billion, he would get stock awards totalling $45 billion and wind up with an additional 12 percent of Tesla's stock. He already owns more than 20 percent of Tesla stock, so in this scenario his net worth would be north of $200 billion, likely making him the world's wealthiest man.

Two advisory firms have a lot of clout

The two advisory firms, Glass Lewis and Institutional Shareholder Services, are urging shareholders to vote no. And a lot of Tesla shareholders will take their recommendations seriously.

Recent decades have seen a shift toward more and more stocks being held by institutional investors like mutual funds, pension funds, and university endowments. Their stock holdings give them the right to participate in shareholder votes in hundreds if not thousands of companies. Yet most don't have the resources to independently research every issue—from executive pay to choosing a board of directors—that comes up for a vote. So they hire shareholder advisory firms to research these issues and advise them on how to vote.

Two companies—ISS and Glass Lewis—dominate this market. ISS has 1,900 institutional clients, while Glass Lewis has 1,200 clients. That gives the two firms significant influence over virtually every vote that's put to shareholders in the United States. And both firms have thrown their weight against Musk's pay package.

That doesn't necessarily mean the plan will be defeated, however. It's extremely rare for shareholders to reject executive compensation plans—only 1.5 percent of Russell 3000 companies that held votes on executive compensation in 2017 had plans rejected by shareholders. One recent analysis found that a "no" recommendation on executive pay from ISS reduces shareholder support by 20 to 30 percent, while a Glass Lewis recommendation cuts support by between 5 and 15 percent. But with the typical proposal being approved with more than 90 percent of the vote, the two firms' "no" recommendations doesn't necessarily mean the Tesla vote will fail.

Predicting the Tesla vote is tricky because Tesla is not a typical company. It is so well-known that many institutional investors may choose to make up their own minds rather than automatically following the recommendations of advisory companies.

Musk himself owns around 22 percent of Tesla shares, but he has vowed to recuse himself from the vote. Institutional shareholders own 58 percent of shares—or 75 percent of non-Musk shares—so they could easily block his pay package if they follow the recommendations of the advisory firms. We'll have to wait until March 21 to see what they decide.

Read Again https://arstechnica.com/cars/2018/03/two-powerful-firms-just-put-elon-musks-huge-tesla-pay-package-at-risk/Bagikan Berita Ini

0 Response to "Two powerful firms just put Elon Musk's huge Tesla pay package at risk"

Post a Comment