Getty Images

At first glance, Tesla

In short, Tesla is revolutionizing transportation and energy, whilst Bitcoin is revolutionizing money and finance. Tesla has an enigmatic, polarizing, charismatic leader in Elon Musk who is often prone to gaffs. However, Bitcoin derives much of its value from having no leading figure or central point of failure.

Despite these obvious differences, the two assets have been amongst the best performing assets this year, often moving together in lockstep. At time of writing, Tesla has appreciated 72% and Bitcoin 23% year-to-date, compared to a decline of 13% for the S&P 500 year-to-date.

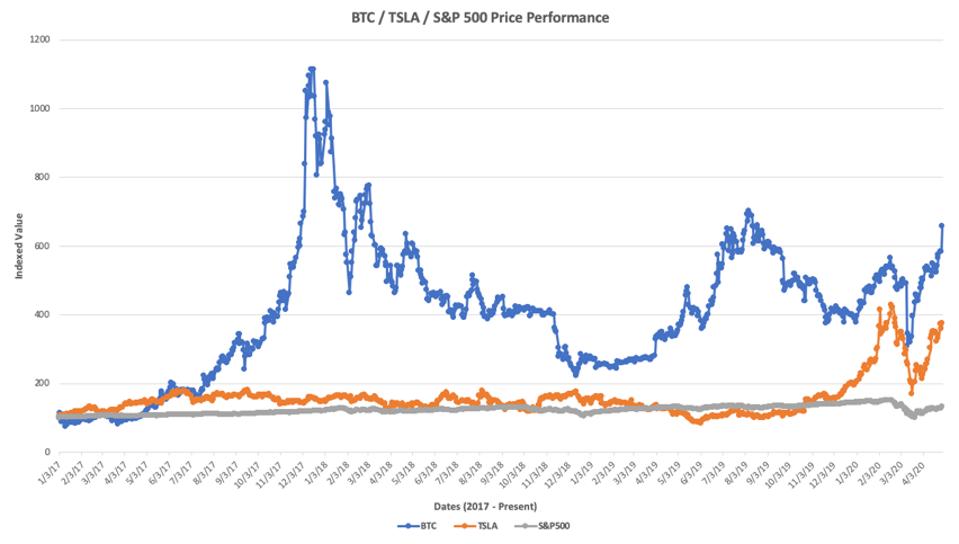

In order to quantify the relationship between Tesla and Bitcoin, I analyzed the price movements of the two assets in relation to the S&P 500 over the last three and a half years. I calculated the daily percentage price changes over this time period and then indexed them starting at 100 to visualize the performance of each asset, shown below.

Indexed price movements of Bitcoin, Tesla, and the S&P 500 from 2017 until now. Bitcoin shown in ... [+]

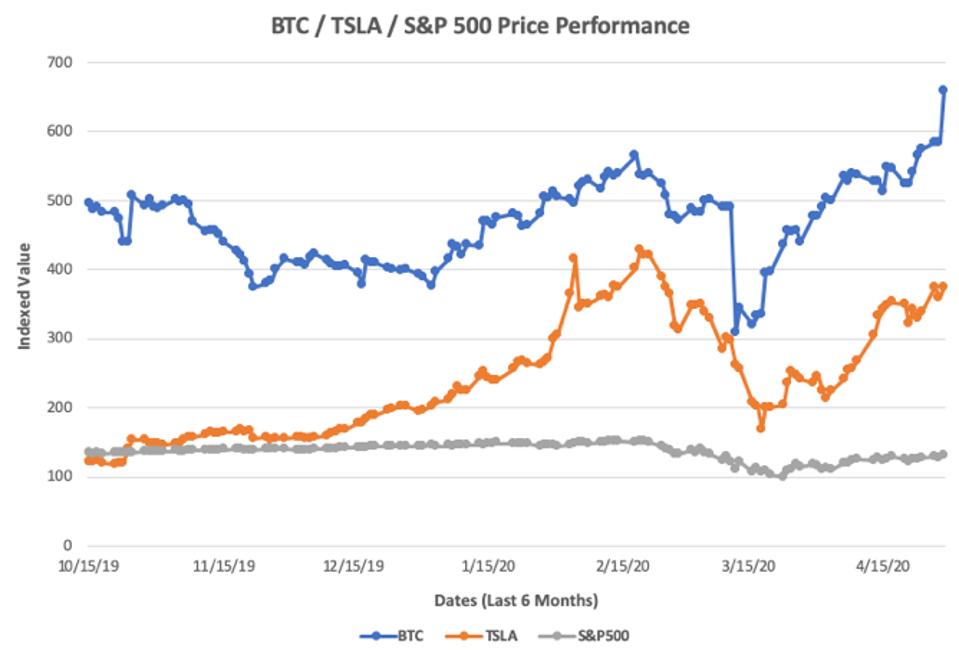

Interestingly, the highest price correlation between Bitcoin and Tesla was in the last six months during the period of October 2019 to April 2020.

Zooming in on the last six months of indexed price movements for Bitcoin, Tesla, and the S&P 500. ... [+]

As a quick primer, correlation is a statistic that measures the degree to which two random variables move in relation to each other. The correlation coefficient has a value between -1 and +1, with 1 implying a perfect positive correlation (i.e. the two assets move perfectly together) and -1 implying a perfect negative correlation (i.e. the two assets move perfectly in opposite directions). Caveat: correlation does not equal causation, and many false correlations do exist. However, correlation can be a decent measurement to help identify when relationships between two assets may exist.

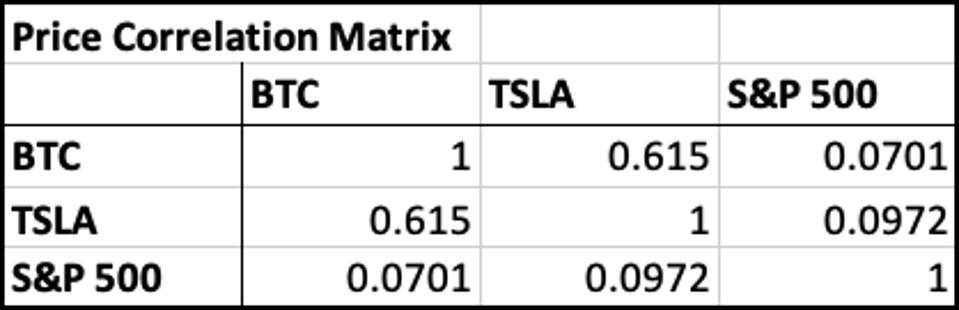

Comparing the price correlations of Bitcoin, Tesla, and the S&P 500 in the last six months yielded the following results:

Matrix displaying the price correlations between Bitcoin, Tesla, and the S&P 500 over the last six ... [+]

Thus, Tesla and Bitcoin exhibited strong correlation of 0.615 over the last six months, significantly higher than both of their correlations with the S&P 500.

One explanation for this high correlation may be that the investor base is similar for both assets. Advocates of Tesla and Bitcoin share a common set of values. Beyond technophiles who believe technology can solve many of society’s pressing problems, Bitcoin and Tesla holders are optimists who believe in narratives of a sustainable future powered by alternative energy and sound money. Proponents of both believe in the ethos of open source technology. Bitcoin is an open source protocol anyone with an internet connection can access. Similarly, in 2014, Elon Musk famously released all of Tesla’s patents to the public “in the spirit of the open source movement.”

Retail investors make up a large portion of both Bitcoin and Tesla holders. Whereas institutions own approximately 80% of the broader equity market, institutions own only 52.8% of Tesla stock. Note, this is not a perfect comparison as some of these institutional investors represent ETFs and funds managed on behalf of retail investors. Similarly, Bitcoin started as a grassroots movement of cypherpunks and grew as it was adopted by libertarians, speculators, and the larger global retail investor base. Although institutional investors are starting to trickle into the crypto markets, retail investors will always serve as its foundation of users and holders.

Taken a step further, a significant percentage of Bitcoin and Tesla investors are “HODLers” (‘Hold On for Dear Life’). These investors believe so deeply in the underlying technology and its societal impact that they will hold the asset no matter how low it dips in the throes of a bear market. Both Tesla and Bitcoin are no stranger to 50%+ dips, which are often accumulated by long term holders with high conviction.

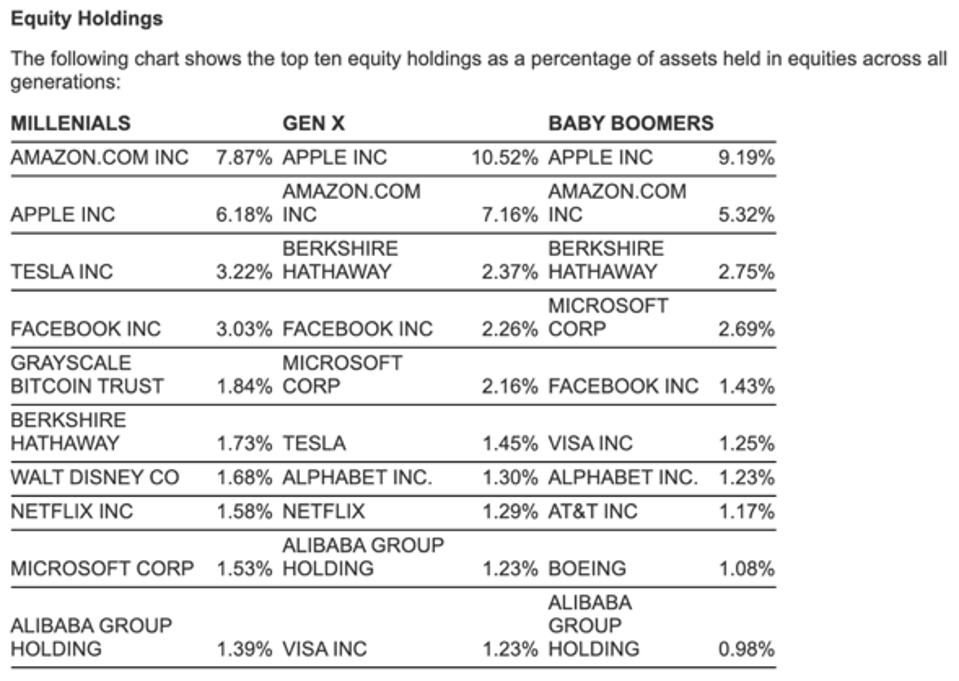

Furthermore, millennials seem to be piling into both Tesla and Bitcoin. A survey by Schwab found that Tesla and Bitcoin were in the top five of all equity holdings for millennials.

According to a survey by Schwab, Tesla and Bitcoin are both within the top 5 equity holdings of ... [+]

Despite the positive price action for both Bitcoin and Tesla, there are concerns that neither asset is currently appropriately valued and may be experiencing speculative bubbles. Both assets present unique risks as they combat determined incumbent players. In the automotive industry, the likes of GM, Ford, Toyota, Honda, and Audi are rolling out their own electric vehicle initiatives, and Bitcoin will fight legacy financial services and banking institutions comprising ~20% of total U.S. GDP. As Bitcoin and Tesla continue to gain market share, bigger wars with incumbents will ensue.

Tesla and Bitcoin will continue to be volatile assets largely driven by retail sentiment. However, at their best, they represent society’s ambitions to use technology and entrepreneurship to solve its biggest issues today and in the future.

Read Again https://www.forbes.com/sites/leeorshimron/2020/05/05/tesla-and-bitcoin-have-more-in-common-than-you-think/Bagikan Berita Ini

0 Response to "Tesla And Bitcoin Have More In Common Than You Think - Forbes"

Post a Comment