World leaders are gathering in Glasgow — or in the case of the top carbon-dioxide emitter, China, by video link — for the United Nations 26th Conference of Parties, or COP26, to discuss climate change. Potentially, they may reach more ambitious 2030 and 2050 targets.

It’s a big moment for investors as well, as they try to identify the companies best positioned to take advantage of decarbonization. According to Morgan Stanley, there are four key actions that COP26 will try to secure: accelerating the phaseout of coal, curtailing deforestation, speeding up the switch to electric vehicles and encouraging investment in renewables.

What’s interesting about Morgan Stanley’s list of companies that are set to benefit is how many rank among the world’s dirtiest, including oil producers Exxon Mobil

XOM,

In fairness, the Morgan Stanley list isn’t entirely fossil fuel companies. SolarEdge Technologies

SEDG,

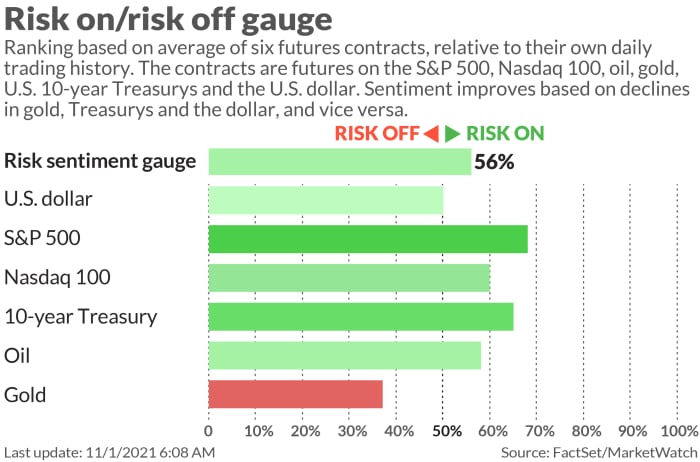

The chart

Bill Ackman, the chief executive and founder of hedge fund Pershing Square Capital Management, is calling for the Federal Reserve to raise rates “as soon as possible” — and made that case to the New York Fed. At his presentation, Ackman argued both the unemployment rate is lower and inflation measures are substantially higher than the beginning of prior rate-hike cycles. Pershing Square in March disclosed an interest-rate swaption, which initially cost $157 million but “has a potential payoff that is many multiples of our credit at risk.”

The buzz

The U.S. and the European Union agreed a deal to ease tariffs on steel and aluminum, which also had beneficiaries including Harley-Davidson

HOG,

The U.S. economics calendar includes the Institute for Supply Management’s manufacturing gauge for October, as well as construction spending for September.

U.S. President Joe Biden tested negative for coronavirus disease on Sunday, the White House said, after the press secretary, Jen Psaki, tested positive.

Union workers at Deere & Co.

DE,

The chief executive of Barclays

BCS,

Listen to the Best New Ideas in Money podcast

The market

U.S. stock futures

ES00,

The Nikkei 225

NIK,

Random reads

Rest in peace, “father of tiramisu.”

The fictional Ted Lasso’s famous biscuits are becoming reality.

“How do you do, fellow kids?” Actor Steve Buscemi dressed up as his own meme.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.

https://www.marketwatch.com/story/exxon-mobil-as-cop26-play-heres-why-morgan-stanley-says-some-of-the-dirtiest-companies-will-benefit-from-decarbonization-11635764450

2021-11-01 12:00:00Z

CAIiEL0DNeyB5rktjNq5SgNRIH8qGAgEKg8IACoHCAowjujJATDXzBUwiJS0AQ

Bagikan Berita Ini

0 Response to "Exxon Mobil as COP26 play? Here's why Morgan Stanley says some of the dirtiest companies will benefit from decarbonization. - MarketWatch"

Post a Comment