By Jorge Aguirre

The Inflation Reduction Act (a sweeping $750 billion health care, tax and climate bill) was signed into law by President Joe Biden.

Included in the package are some incentives that will make buying electric cars in the US more affordable. The caveat is some of the most popular EVs being sold won’t see any difference.

A tax credit of up to $7,500 will be offered to purchasers of new all-electric vehicles and hybrid plug-in vehicles through 2032. For used versions of these vehicles, the plan would also establish a supplementary tax credit worth a maximum of $4,000.

However, the legislation also introduces additional restrictions on who can be eligible for the credit and which vehicles are eligible for it.

For brand-new cars, the manufacturer's suggested retail price for sedans must be less than $55,000 in order to qualify for the tax credit. For SUVs, trucks and vans, the maximum price would be $80,000.

That price cap effectively leaves out the Tesla Model X and Model S, which start at over $100,000, alongside other premium vehicles like the Mercedes EQS, Porsche Taycan, and GMC Hummer. Some of the more expensive configurations of the Tesla Model 3 won't qualify either.

Which Tesla Models Qualify

The only Model 3 that would currently qualify is the entry-level, rear-wheel drive model, which costs around $47,000. This model would be able to take full advantage of the federal tax credit.

Tesla recently discontinued orders for the all-wheel drive Model 3 Long Range model, which could have made the $55,000 cutoff if it received a small price reduction. It'll be interesting to see if Tesla begins to offer that model again in the near future.

The Model 3 rear-wheel drive is the only Tesla that is currently sold for under $55,000. Luckily Tesla's Model Y vehicles are classified as SUVs and will also classify under the truck, vans and SUV portion of the tax credit.

Since SUVs can cost up to $80,000 USD and still qualify for the full tax credit, both Model Ys will qualify as well, including the Performance model which currently comes in at just under $70,000.

| Model | Price | Qualifies |

|---|---|---|

| Model 3 RWD | $46,990 | |

| Model 3 Performance | $62,990 | |

| Model Y Long Range (AWD) | $65,990 | |

| Model Y Performance | $69,990 | |

| Model S | $104,990 | |

| Model S Plaid | $135,990 | |

| Model X | $120,990 | |

| Model X Plaid | $138,990 |

This is significant, given that the Model Y and Model 3 are currently the most popular EVs in the United States. In the first half of 2022, more Model Y and Model 3s were sold in the United States than the combined sales of the next ten most popular EVs.

Used electric vehicles must be at least two model years old in order to qualify. The price cap would be $25,000 and the credit would be limited to the lesser of $4,000 or 30% of the cost of the vehicle.

Other hurdles include a requirement for the final assembly needs to be in North America. That should exclude EVs manufactured by Hyundai Motor, Kia, Audi, and Polestar Automotive. Those firms assemble EVs sold in the U.S. in Asia and Europe.

Additionally, the criteria for the EV purchase credit will alter. For instance, there are specifications for the locations of battery pack assembly and the sourcing of battery components. Those specifications appear to be intended to strengthen the American EV supply chain. Around 2024, these new complexities go into effect. The list of approved automobiles is maintained by the Treasury Department.

It's important to note that the existing $7,500 tax credit, which was established in 2008 and 2009 in order to encourage the adoption of electric cars, included a phase-out provision that would apply if a manufacturer sold 200,000 of the vehicles.

Tesla reached that mark in 2018, and as of right now, its electric vehicles are not eligible for the tax credit. The same applies to General Motors and Toyota (including its Lexus brand). But thanks to the revised bill's removal of the 200,000 sales cap, their electric cars would once again be eligible for the credit.

Additionally, single taxpayers with modified adjusted gross income beyond $150,000 would not be eligible for the credit. This income cap would be $300,000 for married couples filing jointly and $225,000 for single people filing as heads of household.

It might seem like a smart idea to purchase an electric vehicle right now given all the changes to the EV tax credit. However, bear in mind that several benefits, such as the removal of manufacturer limitations and the application of the credit at the time of sale, won't take effect until 2024 or the next year.

Even though this modification to the tax incentives will make the already difficult to navigate EV market much more complicated in the immediate term, in the long term it will be great news for customers, especially middle-class mainstream consumers who later on can purchase more affordable EVs.

By Gabe Rodriguez Morrison

In 2020, a Munich court ruled that Tesla used misleading marketing tactics in Germany by using the words "Autopilot" and "Full Self-Driving" for its driver-assist features. The lawsuit was filed by Wettbewerbszentrale (Competition Center), a network of German companies and one of the largest, most influential national self-regulatory institutions.

The allegation was that Tesla’s use of the words “Autopilot included” in its vehicles was false advertising since the car still requires the driver to operate and stay vigilant. It was also alleged that Tesla's Full Self-Driving suite was misleading marketing.

In October of 2021, Tesla appealed the court’s ruling in the Higher Regional Court of Munich, which ruled in Tesla’s favor. The decision was only made public recently, according to TeslaMag.de, an industry insider who was able to confirm the verdict.

This was an important victory for Tesla, as the Competition Center wanted to ban the company’s use of words like “Autopilot” in its marketing. This suggestion was rejected by the Higher Regional Court of Munich, which said that anybody visiting Tesla’s website to purchase an electric vehicle is suitably informed that the product is not fully autonomous.

Despite Tesla's overall win, the court ruled that the company would have to modify some language on its official website in Germany when referring to its vehicles’ upcoming features. Full Self Driving, for example, would have to be listed with an estimated availability rather than “by the end of the year.” More specifically, the feature language can't just read "coming soon," "next up," or "by the end of the year."

Instead, there has to be a date that Tesla expects the feature to be available to its customers. This was only a small win for the Competition Center which initially wanted to ban what they called misleading language on the company website.

The California Department of Motor Vehicles also initiated legal action against Tesla over the company's use of the words “Autopilot” and “Full Self-Driving” for its driver-assist features. The legal action is aimed at preventing the misuse of new vehicle technologies. Tesla’s successful appeal in Germany is hopefully a sign that they will be equally successful in the United States.

By Jorge Aguirre

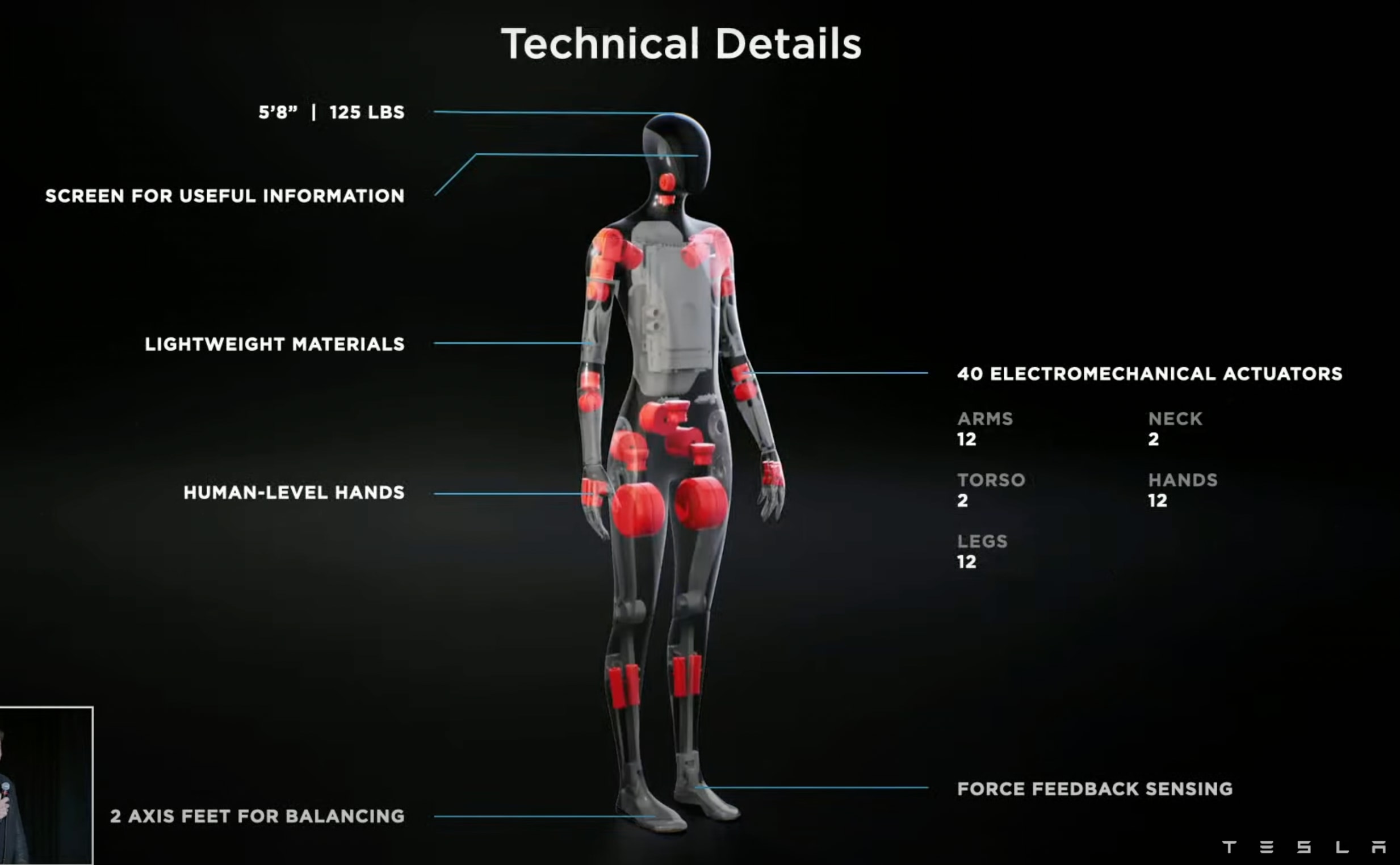

Ahead of the unveil of the first working prototype of the Tesla humanoid robot on September 30, CEO Elon Musk has disclosed more information about Optimus and how he envisages it being used over the next decade.

Musk wrote about a variety of subjects in his column, "Believing in Technology for a Better World," published in China's Cyberspace Administration official journal. He doubled down on his previous statements that the Tesla Bot is intended to replace human labor in repetitive, boring, and dangerous tasks.

Musk also stated that the vision for Optimus is to have the robots serving millions of households globally. Tesla wants the robot to function not only in industrial settings, but also domestic ones.

“Tesla Bots are initially positioned to replace people in repetitive, boring, and dangerous tasks. But the vision is for them to serve millions of households, such as cooking, mowing lawns, and caring for the elderly”, he wrote.

According to Musk, the Tesla Bot was designed in a humanoid form because it will make it easier for humans to accept it, and it will help it integrate better into a world built for humans.

“The Tesla Bot is close to the height and weight of an adult, can carry or pick up heavy objects, walk fast in small steps, and the screen on its face is an interactive interface for communication with people. You may wonder why we designed this robot with legs. Because human society is based on the interaction of a bipedal humanoid with two arms and ten fingers. So, if we want a robot to adapt to its environment and be able to do what humans do, it has to be roughly the same size, shape, and capabilities as a human,” he continued.

The CEO confirmed that he’s planning to launch the first prototype of the humanoid robot this year, while focusing on improving its intelligence and solving the problem of large-scale production.

“Thereafter, humanoid robots’ usefulness will increase yearly as production scales up and costs fall. In the future, a home robot may be cheaper than a car. Perhaps in less than a decade, people will be able to buy a robot for their parents as a birthday gift,” he said.

Elon Musk talks about the Tesla Bot at AI Day

Tesla Bot was first introduced at the first Tesla AI (recap of event) in August of last year.

The Tesla bot will have its own specialized sensory and actuative systems, in addition to being equipped with the same Autopilot computer used in Tesla electric cars, which will enable it to recognize real-world objects.

It will also be able to lift up to 150 pounds, carry 45 pounds, walk at 5 miles per hour, and have human-like hands and visual sensors.

Tesla's Autopilot cameras will be installed on the front of the robot's head, and its inner workings will be powered by the company's Full Self-Driving computer. Tesla's Full Self-Driving computer interface, which is found in all newer Tesla models, will apparently serve as the bots’ brain.

Tesla's AI Day Part II is being held on September 30th, where Tesla is planning to show off an early prototype of the Tesla Bot and potentially its integration of Steam games into Teslas.

Bagikan Berita Ini

0 Response to "We take a look at the new EV tax credit and which Teslas qualify - Not a Tesla App"

Post a Comment