bymuratdeniz

The Crude Reality

The crude reality is that no one really knows what the future price of oil is going to be. Even the Saudi Oil Minister, Ali Al-Naimi, has no idea. When asked about the future price of oil in a CNBC interview, Al-Naimi stated:

No one can set the price of oil. Only Allah knows where prices are heading."

So, I'd like to start by saying all I can do is give my best estimate of how I see things playing out based on certain developments in the energy market at present. I have lived in Texas for most of my life, and actually sold limited liability partnership units in oil and gas ventures as a FINRA registered securities broker at one point in time. The predominant principle I learned was anything can happen, and will. With this in mind, the following is my best guess on where oil's and Exxon Mobil's stock prices are heading. Let's get started!

The Capsized Boat Analogy

This piece is a highly requested follow-up piece to my earlier article on Exxon Mobil. I stated in this article that oil was not going to $140 and Exxon Mobil's stock price had topped out at $110. Furthermore, I disputed the narrative that oil and gas are no longer "cyclical" in nature, but secular. Many stated that we have entered a time where the supply/demand equation will remain unbalanced in favor of higher oil prices ad infinitum. This is clearly not the case.

For those of you who are newer to energy investing, we have seen this movie many times before throughout history. The latest started in the early 2000's. Oil supposedly had peaked in 2007. It was called "The Peak Oil Theory." This was a huge selling point for us in the oil & gas venture business.

So when just about every Wall Street talking head started saying oil and gas prices were set to rise and stay high for the foreseeable future, energy stocks like Exxon Mobil skyrocketed to all-time highs. This was due to the fact the "FOMO" (fear of missing out) phenomenon took hold of market participants and everyone piled in, confident it was a can't miss opportunity. Well, the fact of the matter is, when everyone moves to one side of the boat, it capsizes. I submit we are seeing the inklings of that now. Let me explain.

Oil's Price is heading down, not up

Current Oil Chart

CNBC

According to the newly minted oil price experts, we should have been seeing $140 oil by now. Yet, oil has actually dropped precipitously over the past 6 months and remains in a downtrend. Even Goldman Sachs' $140 a barrel oil prediction, often quoted to me as proof oil was heading higher, has changed. Goldman lowered its oil price prediction substantially a few days ago. The next point I'd like to make is the fact that a steep rise in oil prices has preceded most recessions since World War II.

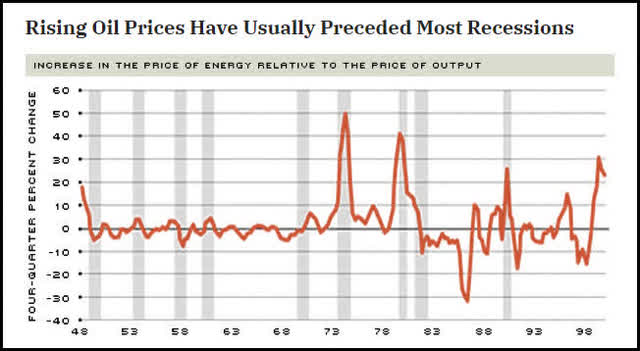

Rising oil prices precede recessions

fred.stlouisfed.org

From the St.Louis Fed:

As the figure shows, nearly all post-World War II recessions in the United States were preceded by, or accompanied by, a sharp increase in energy prices relative to the aggregate price level. As a result, oil price shocks tend to be viewed with alarm by macroeconomists, markets and public policy-makers. This heightened sense of concern is largely an outcropping of the 1970s and 1980s."

I happened to be unlucky enough to be in the oil and gas venture business the last time this phenomenon occurred in 2008/2009.

The Great Recession oil price drop

fred.stlouisfed.org

It was a crazy time. We were selling "tag along" limited liability units in oil and gas ventures at the time. The big oil companies would allocate a certain percentage of the exploration and production plans to various oil and gas venture companies in Texas. Our job was to help raise the money for the venture. In early 2008, business was booming. Oil had spiked to $120+ and the peak oil theory was considered to be truth. We were subscribing a deal a week. Then the recession hit. Oil prices starting dropping like a rock. We couldn't even get anyone on the phone at that point. On top of this, the technology regarding extracting oil from shale rock improved exponentially in 2010 and the entire narrative changed. All of a sudden, we had more oil than we would ever need. No one saw that coming.

There is a high probability we are heading into a recession now. I have a sneaking suspicion Exxon Mobil's stock may be due for a substantial pullback. Here are the reasons why.

Exxon's stock vs Oil's price out of whack

CNBC

Exxon Mobil's stock has historically been highly correlated to oil's price. In fact, it has followed oil's price most of the time rather than lead it. Yet, over the past 6 months, it has continued to rise even as oil's price has fallen drastically. Even so, Exxon's stock price has begun to stall out in 2023.

Current Exxon Mobil Chart

Finviz

Exxon Mobil's stock is up 44% over the past 52 weeks, yet flat for 2023 and down on the week.

Exxon Current Chart

Finviz

Something has got to give in regards to the 20% spread between oil's current price and Exxon Mobil's stock price. After reviewing the data, it appears Exxon's stock is most likely going to drop substantially to meet oil's price rather than vice versa. It is not out of the question that Exxon's stock price will revisit the October 2022 lows if a recession takes hold. Here is why.

Effects on the Supply/demand balance

Currently, the supply/demand status of oil is basically stable, according to Bloomberg Economics.

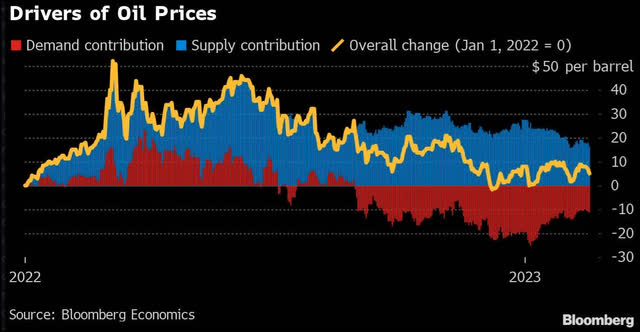

Oil Price drivers

Bloomberg

The latest estimate from Bloomberg Economics states:

Improving oil demand and sufficient supply have offset each other, leaving prices stable since December … remains a goldilocks combo for now."

The words I keyed in on is the "for now" part. If we enter a recession, I see at least $600,000 barrels per day removed from demand as consumers pull back. So, the demand side will definitely take a hit. At the same time, Exxon Mobil's President of oil and gas production business, Liam Mallon, recently stated:

Guyana is central to Exxon Mobil's plan to increase its global oil production by ~13% by 2027, and the company is working to more than triple Guyana production to 1.2M bbl/day by 2027 and may go beyond that."

So you have demand weakening at the same time supply is predicted to increase drastically. That does not bode well for Exxon Mobil's stock price in my book. Many have touted the Guyana discovery as a boon for Exxon Mobil. I say be careful what you wish for. Furthermore, it looks like Guyana wants to claw back 20% of the deal from Exxon Mobil. According to Seeking Alpha news:

Guyana's government plans to take back 20% of the Stabroek offshore oil block that has been responsible for a series of massive discoveries from an Exxon Mobil-led group and remarket it by next year, VP Bharrat Jagdeo told Reuters on Friday."

So Exxon Mobil may have to restate its projected income from the Guyana find. It appears they may have some issues with Kazakhstan production as well. According to Seeking Alpha news:

In a 10-K filing, Exxon ((NYSE:XOM)) also warned of potential risks for its operations in Kazakhstan, where the company produced 246K boe/day of oil and gas last year and exported through the Caspian Pipeline Consortium.

Exxon ((XOM)) said it "could experience a loss of cash flows of uncertain duration from its operations in Kazakhstan," if Russia would interfere with the pipeline's operation, the filing said."

Add to this the fact oil refining crack spreads have been cut in half over the past few months and you have a recipe for declining profits. Exxon's refineries are still minting cash, just at about half the rate due to the drop in gasoline prices after hitting record highs. Finally, I have some complaints about Exxon Mobil's recent announcements regarding the return of capital to shareholders. Here is why.

Exxon Mobil let shareholders down

The primary reason to buy Exxon Mobil's stock has always been for the dividend income. I submit the company has let its shareholder base down. Exxon Mobil reported a blowout quarter last quarter, beating on the top and bottom lines.

Exxon Mobil earnings

XOM

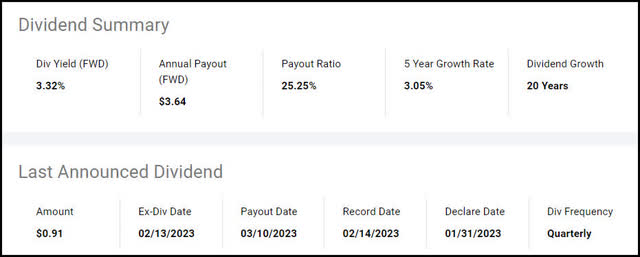

The oil giant had $56 billion in earnings with $77 billion in cash flow from operations. Nonetheless, they did not increase the dividend by even a penny. This has left the yield currently at an anemic level of 3.32%.

Exxon Mobil Dividend Summary

Seeking Alpha

Now, I realize many of you have been holding Exxon Mobil for years and have a much better basis and yield at present. Yet, for anyone looking to start a position now it's "no bueno." You can get a risk-free 4% yield from a money market account right now.

The main point is, I was expecting Exxon Mobil to increase the dividend and they did not. Ok, Ok, I already hear you... they announced a $35 billion buyback program for 2023 and 2024. The issue I have with buybacks is I see them as mostly hot air. They are often used as hedges for management to ensure they lock in their bonuses. Many times they are executed when the stock is trading at high levels and end up being bad buys when the stock falls afterwards. The other issues is there is no guarantee it is even going to happen. Management can just as easily announce a reduction to the buyback at any time. As a shareholder, I'd rather have them take that $35 billion and increase my income immediately. That's just me. Now let me wrap this piece up.

The Wrap-Up

I still don't like the current set up for Exxon Mobil Corporation. I think XOM stock is due to fall back at least 20% from current levels. I believe we are heading into a recession of some magnitude. You will get a much better shot at buying XOM stock in the coming months. The price of oil is not spiking up to $140 and saving the day, either.

On top of all this, it appears Exxon Mobil's earnings are due to be culled back from several different areas. The Guyana find looks like it is being trimmed by 20%, Kazakhstan production may be shut down, and the refining crack spreads are shrinking. Add to this the fact that if a recession hits and Exxon does increase production, oil's price could fall even further. This would not be ideal for Exxon's bottom line. Now is not the time to open a new position in Exxon Mobil as far as I am concerned.

Nevertheless, let me be clear, I am not telling anyone to sell out of Exxon Mobil. Everyone's individual circumstances and suitability are different. I am simply laying out my thoughts on where I believe things are heading for your perusal. I would like to hear from you! What do you think is going to happen next? Which direction are oil and Exxon Mobil's price's heading? Up or Down?

https://news.google.com/rss/articles/CBMiRmh0dHBzOi8vc2Vla2luZ2FscGhhLmNvbS9hcnRpY2xlLzQ1ODE0MDEtZXh4b24tbW9iaWwtdGhlLWNydWRlLXJlYWxpdHnSAQA?oc=5

2023-02-24 13:00:00Z

CBMiRmh0dHBzOi8vc2Vla2luZ2FscGhhLmNvbS9hcnRpY2xlLzQ1ODE0MDEtZXh4b24tbW9iaWwtdGhlLWNydWRlLXJlYWxpdHnSAQA

Bagikan Berita Ini

0 Response to "Exxon Mobil: The Crude Reality (NYSE:XOM) - Seeking Alpha"

Post a Comment