CHUNYIP WONG

Exxon Mobil Corporation (NYSE:XOM) ("ExxonMobil") recently ran investors through their plan for investing in a low-carbon world and the market opportunity afforded to the company. At the same time, the company announced a $1.8 billion drop in quarterly earnings from low liquids prices. In this dual world, now that Exxon Mobil is embracing the future, what's next for investors.

The Low-Hanging Fruit

For those who ignore the reality of climate change, the reality of the matter is, whether or not climate change is real is unimportant. Companies operate in society and a regulatory environment. If the majority of the population follows the science, or the majority of the elected officials do, there's going to be regulation that restricts hefty pollution.

The takeaway is that the existence of climate change is unrelated to whether Exxon Mobil will need to cut its emissions to survive.

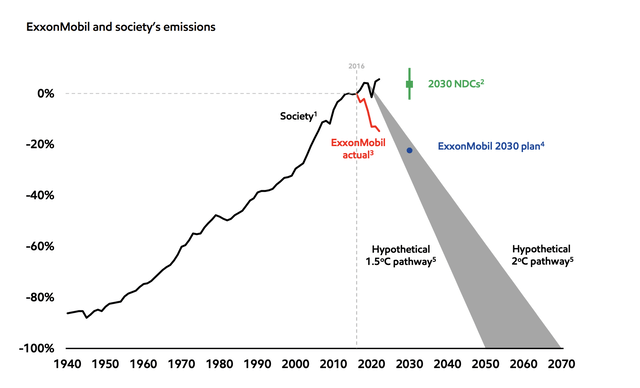

ExxonMobil Investor Presentation

Central to this is the "low-hanging fruit." That's stuff like natural gas flaring, pipeline leaks, etc., which is mostly emitted out of laziness or a lack of a "free solution." That's the stuff that regulation can be expected to be enacted in the relatively near future. Already there are proposals to implement that regulation by organizations such as the EPA.

Regulation has existed for years for other harmful compounds. Those who are wondering about an industry's ability to handle such a change should look at the rapid reaction to the impact of CFCs on the ozone layer and how the situation was handled. ExxonMobil understands the writing on the wall and has rapidly decreased emissions as a result.

More so the company has implicitly showed its agreement for the need to curb emissions to limit anthropogenic warming with its own forecasts. The company's 2030 plan sits in the middle of the need to reduce emissions, and we expect the company to be able to comfortably hit that target. Progressing towards 2040-2050 becomes harder.

ExxonMobil's Strategy

ExxonMobil's strategy is to focus on the industries where it's an expert, a strong proposition but one with some risks.

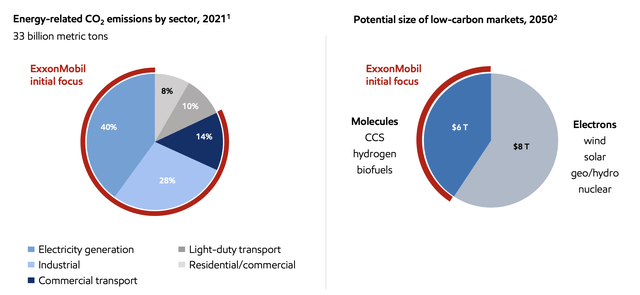

ExxonMobil Investor Presentation

The company is planning to focus on the electricity generation, industrial, and commercial transport sections. The company's planned areas of focus are CCS, hydrogen (blue and green), and biofuels. The company is aiming for Scope 1 and 2 net zero by 2050, although it's reliant on government incentives and support which might become unpopular versus taxes / restrictions.

There is some risk here from the company's lack of focus in direct renewable energy in the long run. We expect wind and solar prices to continue to go down, and they could become price competitive. Still, there are some major benefits for the company's strategy.

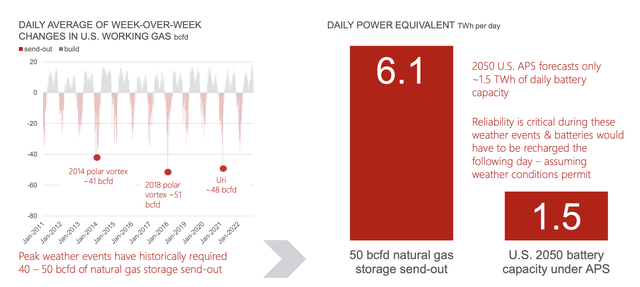

Kinder Morgan Investor Presentation

The above chart shows battery capacity in the United States versus the density of natural gas storage. Natural gas is half the emissions of coal and cheaper, and something like blue hydrogen is a sector where ExxonMobil can grow to make billions off of the United States energy supply. This is a market where the company clearly has the leading position.

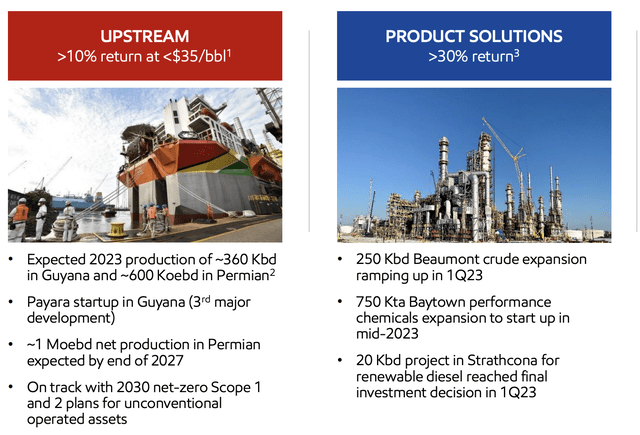

ExxonMobil Core Portfolio

ExxonMobil's core portfolio and technology expertise continue to highlight its value as an investment despite its market cap of almost $500 billion.

ExxonMobil Investor Presentation

The company is ramping up its production, especially in its product solutions area of expertise, where it can achieve >30% returns. The company's potential $1.8 billion in price impact for the quarter is versus 4Q 2022 where it made $14 billion. That implies that the company could still accomplish $10-12 billion in 1Q 2023 earnings.

That would imply an annualized P/E for the company of roughly 9. Given recent strength in prices and OPEC+'s recently announced production cuts indicating the strength of their interest in supporting prices, we expect prices to remain higher. The company is rapidly ramping up the Permian Basin and Guyana, with the two hitting 1 million barrels / day for the year.

We expect them to surpass the 1.5 million barrels / day level over the next few years. Both are low-cost high-quality assets.

Our View

ExxonMobil is a quality company, there's no denying that. The company has market leading assets in upstream and downstream oil. Especially in downstream oil, as refinery demand has been volatile during COVID-19, the company has some of the most complex highest profit margin refineries and chemical operations.

The company's upstream operations are filled with high-quality, high-profit asset, with its massive Permian Basin operations reaching break evens seen only in large onshore Middle Eastern operations. Natural gas has substantial potential in a low-carbon world as well, especially through its ability to replace coal, and with blue and green hydrogen.

ExxonMobil's problem is its valuation. At a $470 billion market capitalization, it's dividend of just over 3% is impressive. Continued share repurchases are respectable. However, it needs $40+ billion / year in profit to justify that valuation, which means it needs Brent prices of at least $75 / barrel. Current prices are above that and OPEC+ is supporting the company.

However, prices have also dropped well below that level for a while in the past, which could significantly hurt the company's ability to drive future returns. As a result, we're overall neutral on Exxon Mobil Corporation, but we recommend cautiously investing for a downturn.

Thesis Risk

The largest risk to our thesis around ExxonMobil is two-fold. It's crude oil prices in the short-term and the growth of renewables in the long run. The company can benefit from a slow-moving world and regulation to support CCS, but in the absence of those its position becomes much more difficult versus the growth of offshore industries such as wind. That could hurt the company's long-term viability.

Conclusion

Exxon Mobil Corporation has announced its low-carbon strategy while highlighting why it, as a company, needs to do something to handle the situation it's found itself in. The company has a quality portfolio of assets and it's able to use its expertise to grow in a rapidly growing low-carbon industry. We can see revenue here crossing the $10 billion mark by the end of the decade.

The company's largest strengths are in natural gas taking market share from more polluting forms of energy such as coal. That can be combined with shifting natural gas production to blue and green hydrogen. Exxon Mobil Corporation does have some risk from its lack of focus on renewables which other energy companies, especially the European majors, have focused on.

Overall, Exxon Mobil Corporation is cautiously a good investment, especially in a downturn.

https://news.google.com/rss/articles/CBMiUWh0dHBzOi8vc2Vla2luZ2FscGhhLmNvbS9hcnRpY2xlLzQ1OTIzOTItZXh4b24tbW9iaWwtZW1icmFjZXMtdGhlLWZ1dHVyZS1ub3ctd2hhdNIBAA?oc=5

2023-04-05 14:13:25Z

CBMiUWh0dHBzOi8vc2Vla2luZ2FscGhhLmNvbS9hcnRpY2xlLzQ1OTIzOTItZXh4b24tbW9iaWwtZW1icmFjZXMtdGhlLWZ1dHVyZS1ub3ctd2hhdNIBAA

Bagikan Berita Ini

0 Response to "Exxon Mobil Embraces The Future - Now What (NYSE:XOM) - Seeking Alpha"

Post a Comment