Bruce Bennett

I have been writing about Exxon Mobil Corporation (NYSE:XOM) for Seeking Alpha since I started 12 years ago. I've written 26 Focus articles on Exxon and several more quick pick articles that are not listed by the ticker. Here is my most recent article history on Exxon Mobil.

David Alton Clark's recent XOM article history

Seeking Alpha

I have lived in Texas for most of my life. I was once involved in the oil & gas business myself. Several times we worked with Exxon Mobil. Exxon Mobil has always been my favorite oil major, and still is. Nonetheless, at times, there can be a vast dichotomy between the company and its respective stock. That is my position at present.

I see Exxon Mobil Corporation stock as substantially overbought currently. First, I want to explain in more detail the strategy behind the "Diversified Cash Flow" income production method. This will help you understand my "Sell" position regarding XOM stock.

The Diversified Cash Flow Methods Explained

My father passed away in 2013 with a multimillion dollar retirement portfolio intact. A major reason for this was the fact that, over the years, he invested in both dividend income producing stocks as well as capital appreciating growth stocks. He broke down each category into two separate subsets based on risk levels. Principle preservation was always a primary concern for my father.

I often read others saying, "don't worry about the stock price, it's all about the yield." Well, my years of experience have taught me that the stock price often tanks just prior to the dividend being slashed or cut completely. A cratering stock price is a red flag that something is going wrong more often than not.

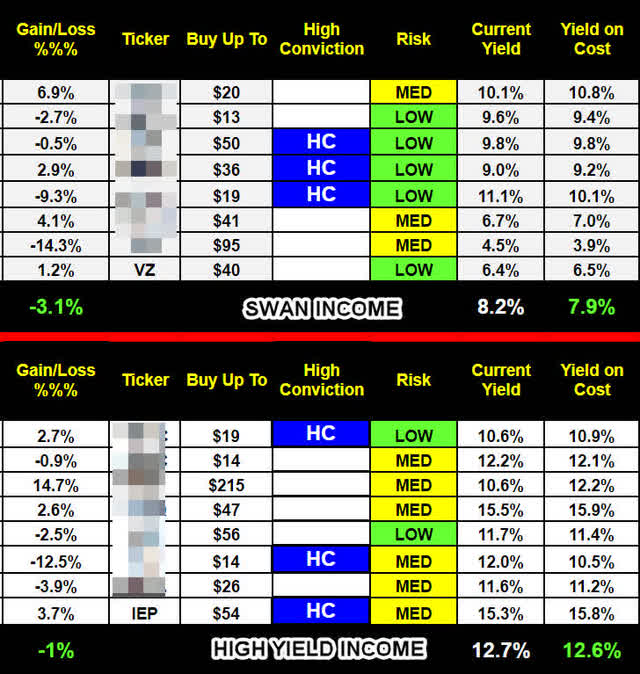

WWI Core Income Portfolios

WWI Income Investing Group

I have divulged Verizon Communications Inc. (VZ) as an example of a SWAN income portfolio constituent, and Icahn Enterprises L.P. (IEP) as an example of a High Yield income portfolio constituent. As you can see, these stocks are producing exemplary income streams, yet not a whole lot of capital appreciation.

The reason for this is quite simple. Companies with the primary objective of returning capital to shareholders don't tend to have an abundance of capital appreciation. They are essentially giving away the company's profits rather than reinvesting them into future growth prospects. That's why my father felt it was important to have funds dedicated to growth stocks with the potential for exponential capital appreciation to keep up with increasing expenses and inflation. He would often take profits on these winners and redistribute the proceeds to increase his income producing holdings or use the profits as income to pay for unforeseen expenses.

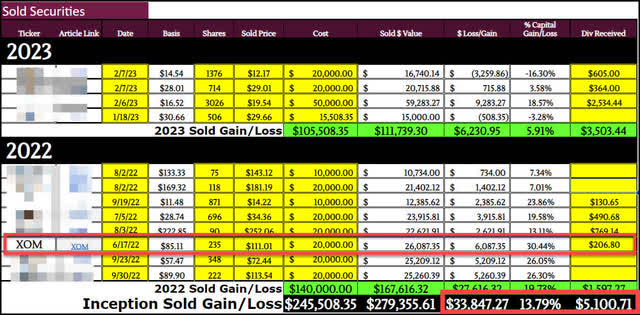

Below is a chart of my Income Investing Group's sold stocks over the past year.

WWI Sold Securities

WWI Income Investing Group

Since inception, the service has booked $33,847 in capital gains and $5,100 in dividend income from sold stocks. The fact of the matter is, there is more than one way to create retirement income. My father focused on the total return of his portfolio, not simply the yield. Retirement Guru Ken Fisher explains it best in his "Definitive Guide to Retirement Income" booklet. Fisher states in the "Income Vs. Cash Flow" section:

"It may seem pedantic, but there is a key distinction between income and cash flow. Income is money received and cash flow is money withdrawn. For example, dividends and bond coupon payments are indeed considered income—you report them as such on your tax returns. These are two completely acceptable sources of funds. But if you rely on them solely, you could be selling yourself short. On the other hand, selling a security also generates cash flow. When you sell a security, the difference between what you put in and what you take out is considered a capital gain (or loss). Note, cash flow withdrawn from your portfolio isn’t a bad thing—and can be a very important component of your overall retirement strategy. Consider: If your portfolio of $1,000,000 grew 10% last year, and you realized $100,000 in annual gains, this really isn’t any different than if your portfolio grew 5% last year and paid $50,000 in dividends. The total return (i.e., capital gains + dividends) is the same on a pre-tax basis; and, depending on your situation, selling a security and paying tax on the capital gains may be more tax-efficient than dividend income! Bottom line: When it comes to paying for your retirement, you should really only be concerned about the total return of your portfolio and after tax cash flow—not whether it comes from selling securities or regular income."

Now that we have covered the basics of my strategy for creating retirement income, let me get to the issue at hand today. Why is Exxon's stock not a viable vehicle at present for prospective income investors?

Exxon Long-term Chart

Finviz

Little chance of upside, paltry yield

The simple fact of the matter is, there is very little chance of significant capital appreciation at present. On top of this, the stock has run up to such an elevated level, the dividend yield of 3.19% has become a negative rather than a positive attribute of XOM stock presently. Why would any reasonable investor buy Exxon Mobil's stock when its trading at all-time highs with a yield of only 3% when you can get a risk free 5% return in treasuries? It doesn't make any sense.

In a way, Exxon's stock is having the same issue the regional banks are having at present. The difference is everyone still has their rose-colored glasses on.

Stock currently overbought

Whenever I write about the fact I sold out at $110 after a 200% gain, I always get a lot of comments from members stating they bought in at $35 for a 10% yield and will never sell. I actually sold out of my Exxon position in the $70s along with all my stocks just prior to the COVID Crash of 2020. I bought back in to Exxon at the $35 level. Nonetheless, after the stock skyrocketed up 200%, I took profits a few months back. I held the position in a tax-advantaged account. I stated I would look for an opportunity to reenter the stock, yet not before XOM at least yields 5%.

The OPEC+ pop

When Exxon's stock popped on the news of an OPEC+ production cut, several posters took the opportunity to gloat, saying that I had made a mistake in selling. Yet, none of them took the time to consider I am not a short-term trader. I am a retirement income investor and just locked in 20 years' worth of dividends at a 10% yield. I am 60 at present, I will be lucky if I make it to spend it all! Ha! Plus, I redeployed a half of the proceeds into stocks yielding 12% on average. So, I increased my dividend income and tucked away a 100% gain. That is the virtue of the Diversified Cash Flow Methodology.

One caveat is you have to be actively involved in managing your retirement account. If you don't have the time or inclination to be involved, I suggest turning over management of your retirement account to a professional. The Ron Popeil days of "set it and forget it" are over.

Now let's turn our attention to the recent developments regarding Exxon Mobil Corporation and its stock.

The Party is Over

Finviz

Any further upside is highly unlikely at these elevated levels. Exxon's stock is currently trading just 3% off its 52-week high at present. Furthermore, it is trading at a 45% premium to its 200-month SMA of $80. This is due to the fact analyst and investors alike have been pounding the table on Exxon Mobil and energy stocks in general. Nevertheless, at a certain point, a majority of investors have already bought in and the stock starts to roll over. This has happened several times over the years. I see this time as no different. Furthermore, XOM stock is trading at a premium on a price to book value metric as well.

Exxon Mobil Price/Book value metrics

Seeking Alpha

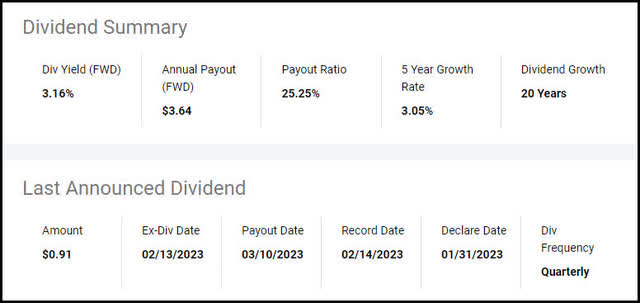

The price to book value metrics show Exxon Mobil's stock is trading at a 40-50% premium to its peers and five year average. These statistics confirm my previous statement that the stock is currently trading at a 45% premium to its 200-month moving average of $80. So, there is very little chance of further upside at present, and the dividend yield stands at a paltry 3.16%.

Exxon Mobil Dividend Summary

Seeking Alpha

With such an insignificant yield and little chance of further upside from present levels, I see no reason to initiate a new position in Exxon Mobil right now. Now let's wrap this piece up.

The Wrap-Up

It seems as though many of the Exxon Mobil bulls are currently basking in their glory. I say, congratulations! Even so, it may be time to take your rose-colored glasses off. I believe the party is about to end and there is asymmetric risk to the downside.

In fact, Exxon just stated yesterday that it expects profits to take a huge hit in the latest quarter. According to Seeking Alpha News:

"Exxon Mobil's Q1 operating profit pulled back from last year's record levels, according to an 8-K filing released Tuesday, as oil and gas prices cooled off compared to the final quarter of 2022.

Q1 operating profit from the oil and gas business is expected to drop by $1B-$1.8B from the $8.2B amassed in Q4 2022, while unsettled derivatives could hit profit by $1.8B-$2.2B in the latest quarter.

Lower oil prices are expected to hit upstream earnings by $600M-$1B in Q1 compared with Q4, and lower natural gas prices should knock $400M-$800M from upstream earnings, according to the filing."

On top of this, Exxon just announced its highly touted major campaign to find oil in the deep waters off the coast of Brazil has come up empty. Again according to Seeking Alpha News:

"Exxon Mobil has ended a major campaign to find oil in Brazil, after coming up empty for the third time to find commercially viable amounts of crude in Brazil's deep waters last year, The Wall Street Journal reported Wednesday, marking a major setback in a country it has promoted for years as a key source of growth.

Exxon (XOM) has shifted geologists and engineers who had worked on the years-long drilling campaign from its offices in Rio de Janeiro to other countries including Guyana, Angola and Canada, according to the report.

As recently as December, Exxon (XOM) CEO Darren Woods pointed to Brazil as one of its major "growth opportunities" and part of its portfolio of low-cost supply developments, alongside Guyana and the Permian Basin in the U.S., as well as exports of liquefied natural gas."

And lastly, Exxon is being sued by Kazakhstan over billions in revenue as well. Seeking Alpha News again:

"The companies operating the Kashagan and Karachaganak oil fields in Kazakhstan are being taken to arbitration by the country's government over allegations of unapproved spending, with billions of dollars of revenue at stake, Bloomberg reported Wednesday.

The government claims partners in the projects should not deduct a combined $16.5B in costs for the two oil fields, according to the report; if the government is successful, it could receive a greater share of revenue from the fields, under the terms of production-sharing agreements.

Shell (NYSE:SHEL), Exxon Mobil, Eni (E), TotalEnergies (TTE) and state-run KazMunayGas National Co. are the main partners who have spent more than $50B in the Kashagan project, one of the world's largest oil fields; the partners in the Karachaganak project, led by Shell and Eni, have spent at least $27B."

So, with all these headwinds on the horizon coupled with the odds of a recession increasing due to the banking crisis, I don't see much of a reason to put new money to work in Exxon Mobil Corporation presently. If you are a long-term buy and hold investor who has locked in a substantial yield, I say stay the course if you choose to. Exxon will definitely never cut the dividend. You may, however, want to look into using covered calls to enhance your premium and protect your position from downside.

Those are my thoughts on the matter I look forward to reading yours.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

https://news.google.com/rss/articles/CBMiRmh0dHBzOi8vc2Vla2luZ2FscGhhLmNvbS9hcnRpY2xlLzQ1OTI1MjgtZXh4b24tbW9iaWwtdGhlLXBhcnR5LWlzLW92ZXLSAQA?oc=5

2023-04-06 12:00:00Z

CBMiRmh0dHBzOi8vc2Vla2luZ2FscGhhLmNvbS9hcnRpY2xlLzQ1OTI1MjgtZXh4b24tbW9iaWwtdGhlLXBhcnR5LWlzLW92ZXLSAQA

Bagikan Berita Ini

0 Response to "Exxon Mobil Stock: The Party Is Over (NYSE:XOM) - Seeking Alpha"

Post a Comment