Brandon Bell

We last covered Pioneer Natural Resources Company (NYSE:PXD), or Pioneer, in September 2022, when we urged investors to remain patient. Investors new to Pioneer should know that the company is the largest independent E&P producer in the Permian Basin.

It has deep inventory in the region and is sitting on "about 30 years of premium inventory." In addition, the company highlighted its leading acreage quality, which produced more free cash flow, or FCF, per barrel of oil equivalent, or BOE, in 2022 over its leading peers.

Pioneer acquired most of its acreage "at an average cost of around $500 per acre." As such, it gives the company a significant cost advantage against its peers, resulting in industry-leading operating performance metrics.

Notably, most of PXD's assets are located "in the core of the play," which likely attracted the attention of Exxon Mobil Corporation (XOM) recently. Keen investors should know that the WSJ ran an exclusive highlighting that XOM is in "preliminary talks with Pioneer Natural Resources about a possible acquisition."

However, investors must note that the talks are still in the early stages and may not result in an acquisition, even though the market has attempted to price in the optimism. Accordingly, PXD is up more than 8% in pre-market at writing as investors assess the outcome of the talk.

Notwithstanding, it does highlight the high quality and depth of Pioneer's Permian assets. A successful acquisition could lift the combined entity to be the most significant Permian producer over Occidental Petroleum Corporation (OXY) based on their combined total production of about 1.2M BOE per day in FY22.

As such, investors who didn't capitalize on the recent steep decline to the $180 level have missed out on the recent recovery, as PXD recovered its losses from March over the past three weeks.

We urged investors in September to consider the opportunity to add exposure if PXD dips below the $200 level, which saw buyers return with high conviction over the past few weeks.

Of course, Pioneer and its energy peers received a massive boost from OPEC+'s decision to slash nearly 1.2M barrels per day recently to stem a further decline in crude oil prices.

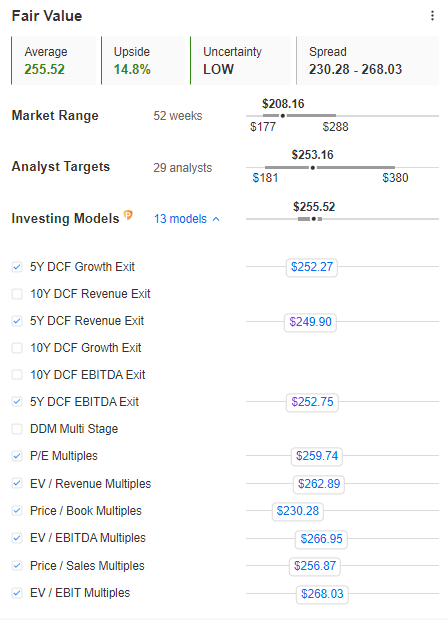

PXD blended fair value estimate (InvestingPro)

However, with the pre-market recovery pricing in a potential acquisition, is the margin of safety still adequate for investors sitting on the sidelines?

We assessed that PXD's blended fair value estimate implies a potential upside of nearly 15%, despite factoring in the pre-market surge. Furthermore, PXD's NTM EBITDA multiple remains well below its 10Y average of 9x.

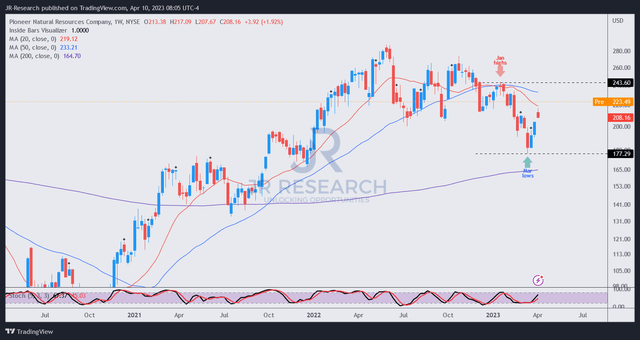

PXD price chart (weekly) (TradingView)

A closer inspection of PXD's price action suggests that it's closing in against its January resistance level of $245, which could attract sellers who picked its March lows to take profit.

Despite that, we also gleaned that PXD's price action on its long-term chart is constructive and consistent with what we would typically consider for long-term uptrend continuation.

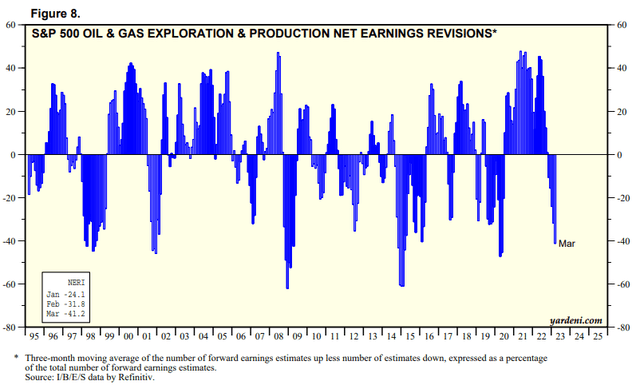

S&P 500 E&P industry net earnings revisions % (Yardeni Research)

Moreover, we gleaned that Wall Street analysts have already turned highly pessimistic on the earnings projections for E&P players, marking down their earnings revisions southwards in preparation for macroeconomic uncertainty.

The pace of revisions intensified in March, given the banking crisis, which also saw underlying oil prices and energy stocks taking out new recent lows, including PXD.

Hence, the contrarian signal from Wall Street's pessimism is likely setting up PXD well for a medium-term recovery, auguring well for the price action signals in its long-term chart.

However, we caution that near-term volatility should still be expected as PXD moves into overbought zones. Investors should consider taking advantage of downside volatility to average down and add their positions progressively.

As highlighted, Pioneer Natural Resources Company levels closer to $200 should continue to attract significant buying support.

Rating: Buy (Revised from Hold).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone to learn better!

https://news.google.com/rss/articles/CBMibWh0dHBzOi8vc2Vla2luZ2FscGhhLmNvbS9hcnRpY2xlLzQ1OTMxODUtcGlvbmVlci1uYXR1cmFsLXJlc291cmNlcy1leHhvbi1tb2JpbC1zZW5kcy1hLW1lc3NhZ2UtcmF0aW5nLXVwZ3JhZGXSAQA?oc=5

2023-04-10 14:00:49Z

CBMibWh0dHBzOi8vc2Vla2luZ2FscGhhLmNvbS9hcnRpY2xlLzQ1OTMxODUtcGlvbmVlci1uYXR1cmFsLXJlc291cmNlcy1leHhvbi1tb2JpbC1zZW5kcy1hLW1lc3NhZ2UtcmF0aW5nLXVwZ3JhZGXSAQA

Bagikan Berita Ini

0 Response to "Pioneer Natural Resources Stock: Exxon Mobil Sends A Message (Rating Upgrade) (NYSE:PXD) - Seeking Alpha"

Post a Comment