Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Exxon Mobil Corporation (NYSE:XOM) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Exxon Mobil

What Is Exxon Mobil's Debt?

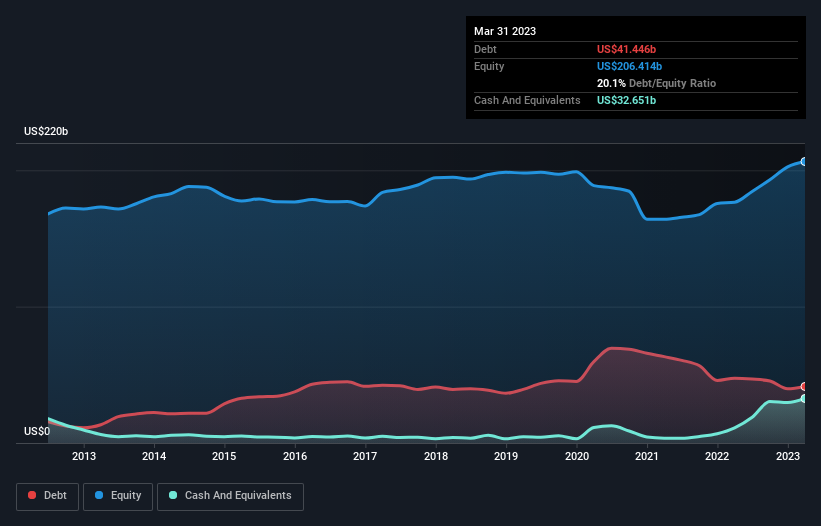

The image below, which you can click on for greater detail, shows that Exxon Mobil had debt of US$41.4b at the end of March 2023, a reduction from US$47.5b over a year. However, it also had US$32.7b in cash, and so its net debt is US$8.80b.

How Healthy Is Exxon Mobil's Balance Sheet?

We can see from the most recent balance sheet that Exxon Mobil had liabilities of US$66.7b falling due within a year, and liabilities of US$96.3b due beyond that. Offsetting this, it had US$32.7b in cash and US$38.8b in receivables that were due within 12 months. So it has liabilities totalling US$91.5b more than its cash and near-term receivables, combined.

While this might seem like a lot, it is not so bad since Exxon Mobil has a huge market capitalization of US$425.0b, and so it could probably strengthen its balance sheet by raising capital if it needed to. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

With debt at a measly 0.093 times EBITDA and EBIT covering interest a whopping 100 times, it's clear that Exxon Mobil is not a desperate borrower. So relative to past earnings, the debt load seems trivial. Even more impressive was the fact that Exxon Mobil grew its EBIT by 129% over twelve months. If maintained that growth will make the debt even more manageable in the years ahead. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Exxon Mobil's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we always check how much of that EBIT is translated into free cash flow. During the last two years, Exxon Mobil generated free cash flow amounting to a very robust 89% of its EBIT, more than we'd expect. That puts it in a very strong position to pay down debt.

Our View

Exxon Mobil's interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. And that's just the beginning of the good news since its conversion of EBIT to free cash flow is also very heartening. Overall, we don't think Exxon Mobil is taking any bad risks, as its debt load seems modest. So the balance sheet looks pretty healthy, to us. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Exxon Mobil is showing 1 warning sign in our investment analysis , you should know about...

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

What are the risks and opportunities for Exxon Mobil?

Exxon Mobil Corporation engages in the exploration and production of crude oil and natural gas in the United States and internationally.

Rewards

Trading at 22.9% below our estimate of its fair value

Earnings grew by 139.2% over the past year

Risks

Earnings are forecast to decline by an average of 15.5% per year for the next 3 years

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

https://news.google.com/rss/articles/CBMid2h0dHBzOi8vc2ltcGx5d2FsbC5zdC9zdG9ja3MvdXMvZW5lcmd5L255c2UteG9tL2V4eG9uLW1vYmlsL25ld3MvZXh4b24tbW9iaWwtbnlzZXhvbS1zZWVtcy10by11c2UtZGVidC1yYXRoZXItc3BhcmluZ2x50gF7aHR0cHM6Ly9zaW1wbHl3YWxsLnN0L3N0b2Nrcy91cy9lbmVyZ3kvbnlzZS14b20vZXh4b24tbW9iaWwvbmV3cy9leHhvbi1tb2JpbC1ueXNleG9tLXNlZW1zLXRvLXVzZS1kZWJ0LXJhdGhlci1zcGFyaW5nbHkvYW1w?oc=5

2023-06-18 12:55:31Z

CBMid2h0dHBzOi8vc2ltcGx5d2FsbC5zdC9zdG9ja3MvdXMvZW5lcmd5L255c2UteG9tL2V4eG9uLW1vYmlsL25ld3MvZXh4b24tbW9iaWwtbnlzZXhvbS1zZWVtcy10by11c2UtZGVidC1yYXRoZXItc3BhcmluZ2x50gF7aHR0cHM6Ly9zaW1wbHl3YWxsLnN0L3N0b2Nrcy91cy9lbmVyZ3kvbnlzZS14b20vZXh4b24tbW9iaWwvbmV3cy9leHhvbi1tb2JpbC1ueXNleG9tLXNlZW1zLXRvLXVzZS1kZWJ0LXJhdGhlci1zcGFyaW5nbHkvYW1w

Bagikan Berita Ini

0 Response to "Exxon Mobil (NYSE:XOM) Seems To Use Debt Rather Sparingly - Simply Wall St"

Post a Comment