Joe Raedle

Background

Those with even slightly more than a passing interest in the complex world of oil majors has likely heard of or read Private Empire: ExxonMobil and American Power, by Steve Coll. Published in 2013, the book is a behind the scenes account of how Exxon Mobil Corp (NYSE:XOM) spent decades in the integrated multi-national oil landscape, eventually building a corporation capable of going toe-to-toe with governments.

The resulting company and the culture within was in our opinion--and is--considered to be conservative, insular, and even stuffy.

Following the publication of Private Empire, however, the oil landscape shifted beneath everyone's feet.

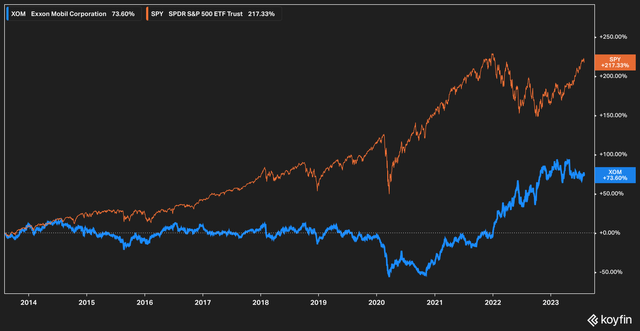

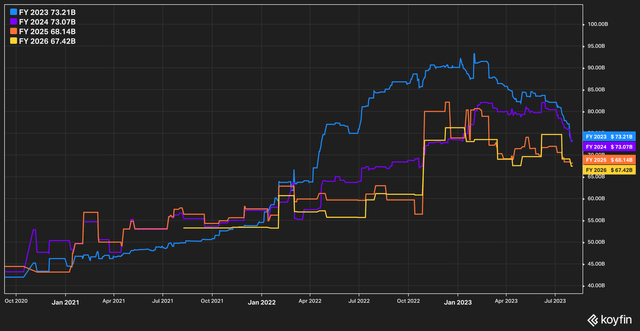

Koyfin

After oil prices collapsed by nearly 60% in the back half of 2014, oil companies around the world--including the majors--faced a great reckoning, and Exxon's stock spend the better part of the next seven years in the doldrums (as seen in the chart above). Investors, burned by the collapse, largely treated the oil industry as too risky for long-term investment, or even as going the way of the dinosaur entirely.

It was only in the post-COVID world that oil companies received much needed shots in the arm. Over the past three years the stock has rallied by a little more than 190% on a total return basis, handily beating the broader S&P 500's (SPY) return of 44% over the same period.

In this article we will outline a few of the major points that we believe point to the fact that a new day is dawning at Exxon, and why we think the run can continue.

Let's dive in.

New Culture?

Taking the helm of the oil giant in 2017, CEO Darren Woods has seen the boom and bust cycles of oil firsthand. Having joined Exxon in 1992, he is also intimately familiar with the inner workings of the company, as well as its cultural foibles. It was surprising, then, when the company announced in early 2022 that it would be relocating from its long-time headquarters in the Dallas area to Spring, Texas, outside Houston.

More notably for observers, though, is the fact that the company's longstanding symbol of corporate secrecy and hierarchy--the 'God Pod', as it was known--would not move in spirit to Spring with the company.

The God Pod, full of fine art and even finer dining, and accessible only by Exxon elite and their visitors, is in many ways a monument to the culture of business past. While the new office will of course have an executive suite, the new office is said to be much more streamlined and designed to place executives physically in place with the majority of Exxon's home office employees.

While difficult to quantify, anyone who has worked for a major corporation is likely to attest that proximity matters. Investors should remind themselves that stock purchases are purchases of organizations run by humans, and those organizations are subject to administrative pitfalls and bottlenecks, and that organizational structures can have major impacts on companies.

The elimination of the God Pod and the move to a new campus is also part of a wider, multi-billion dollar spending reduction plan at Exxon. It is especially notable (and attests to the seriousness of management) that the company is moving full-steam ahead with this plan even after smashing profitability records in 2022.

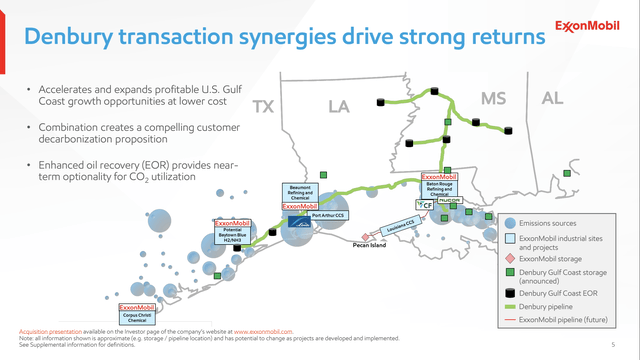

Denbury

Exxon's recent $4.9 billion acquisition of Denbury was, in our minds, a corporate masterstroke for a few reasons. The purchase of a company with 1,300 miles of pipeline dedicated to carbon capture and storage allows Exxon to make progress on the public relations front that it is doing what it can to address carbon emissions, while also taking advantage of massive tax incentives provided by the Inflation Reduction Act for companies that capture and store carbon.

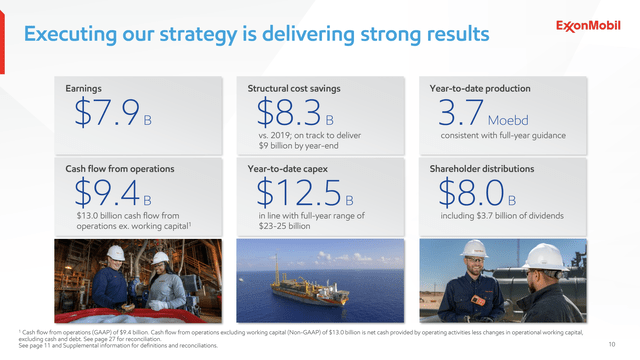

Exxon Quarterly Investor Presentation

Exxon states that it has already sequestered 120 million metric tons of CO2, and executives estimate that once Denbury's CO2 pipeline is fully optimized it will be able to sequester up to 100 million metric tons per year.

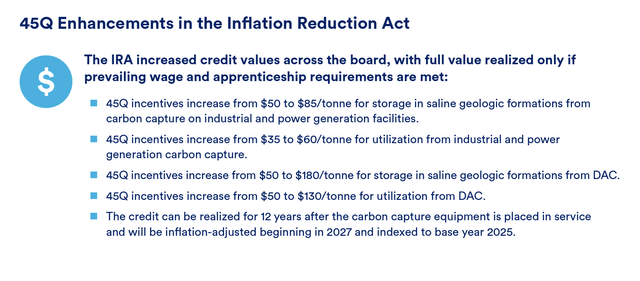

The incentive here for Exxon and its shareholders is quite large. Under the Inflation Reduction Act, the 45Q tax credit (which covers incentives for carbon sequestration) raises the incentive to store carbon in saline geographic formations (aka, underground) from $50 per tonne to $85 per tonne (pictured below).

Clean Air Task Force Presentation

While the incentives are nice, to say the least, we also point out that incentives of this kind (and the ability to act on them) will allow a degree of cyclicality to exit Exxon's business. While the price of oil will of course dominate the moves of the stock as it always has, cash flow from carbon capture should remain consistent.

Value In The Stock

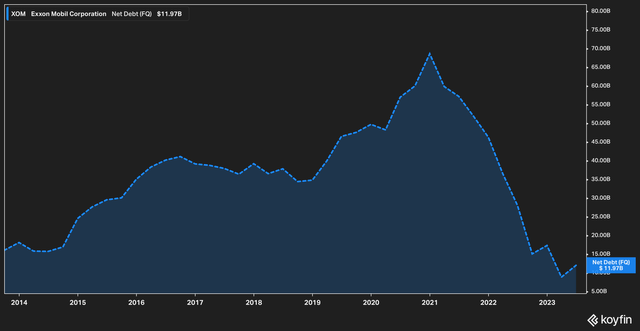

Exxon not only has solid prospects ahead of it from a cultural and regulatory standpoint--it is on better footing financially than it has been in years. The bumper year of 2022, for example has seen the company's net debt slashed to levels not seen since 2013.

Koyfin

Analysts also expect this positive trend to continue, with consensus net debt in the coming year to be roughly $6.6 billion from the nearly $12 billion today--a far cry from the near $70 billion the company carried at the start of 2021.

Given the cyclical nature of the industry, analysts do not expect that the boom times will continue, as EBTIDA expectations have softened, and we believe investors will inevitably have a tough time stomaching the next few quarter's results against difficult 2022 comps.

Koyfin

We point out, however, that the estimates going forward and the price today assign a relatively cheap valuation for the company. For example, average analyst estimates of $73.2 billion for 2023 imply an enterprise value multiple of the company of 6.2x, which is in our opinion relatively low, especially given the company's steady expansion into non-cyclical enterprises like carbon capture.

Against this multiple, we note that Exxon's plan to cut spending isn't all fluff.

Company Presentation

In the last quarter management stated that they had driven structural cost savings of $8.3 billion and were on track to hit $9 billion by the end of the year versus 2019 (the last pre-pandemic comp).

We highlight the 'structural' portion of this, because it reflects a renewed leanness of Exxon's operations as something enduring, rather than a one-time cost saving, such as a tax benefit.

The Bottom Line

While there is so much more to explore with Exxon that we like--from its revamped trading operation, the expanding output in the Permian, the accelerating development of its Guyana project--there is only so much that can be devoted to one article.

For us, we believe that the embracing of the tax credits provided by the Inflation Reduction Act via the acquisition of Denbury along with the cost reduction and downsizing of corporate headquarters are meaningful moves to make Exxon a more lean and mean organization overall.

https://news.google.com/rss/articles/CBMiUWh0dHBzOi8vc2Vla2luZ2FscGhhLmNvbS9hcnRpY2xlLzQ2MjMzODktZXh4b24tbW9iaWwtaXMtZ2V0dGluZy1sZWFuZXItYW5kLW1lYW5lctIBAA?oc=5

2023-08-03 18:44:06Z

CBMiUWh0dHBzOi8vc2Vla2luZ2FscGhhLmNvbS9hcnRpY2xlLzQ2MjMzODktZXh4b24tbW9iaWwtaXMtZ2V0dGluZy1sZWFuZXItYW5kLW1lYW5lctIBAA

Bagikan Berita Ini

0 Response to "Exxon Mobil Is Getting Leaner And Meaner (NYSE:XOM) - Seeking Alpha"

Post a Comment