CHUNYIP WONG

Exxon Mobil Corporation (NYSE:XOM) is the largest of the energy supermajors. The company has a market capitalization of roughly $421 billion. The company has generated substantial profits from Russia's invasion of Ukraine, but those profits have dwindled. While we've recommended investing in the company numerous times before, as we'll see throughout this article, it's overvalued.

Exxon Mobil Targets

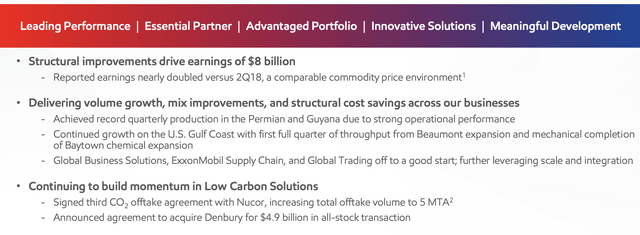

The company has focused on continuing to improve its portfolio and driving strong earnings.

ExxonMobil Investor Presentation

The company has managed to improve its portfolio to nearly double earnings at the same price environment. That enabled the company to earn $8 billion in additional earnings. The company is focused on continuing to grow volumes and implementing cost savings, while expanding its low carbon portfolio. That should enable the company to continue moving towards its targets.

Exxon Mobil Denbury

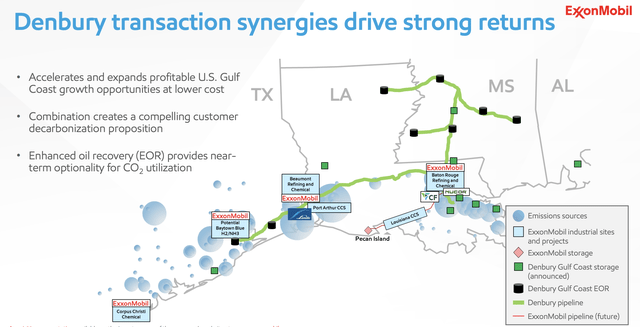

Among the most exciting news to happen from Exxon Mobil in recent years is the company's acquisition of Denbury.

ExxonMobil Investor Presentation

Denbury is an expert at CO2 enhanced oil recovery, specifically used CO2 / carbon capture to extract oil from reservoirs that are already depleted. Exxon Mobil paid $4.9 billion for this acquisition, which enables the company to both improve its oil utilization, and capture major pollution sources along the Gulf Coast.

The company is looking to increase its carbon capture, and this acquisition is a great way for the company to do that. Handling that increases the company's ability to survive for the future. Decreasing the emissions of its industry increases the chance that the industry can survive.

Exxon Mobil Industry Pricing

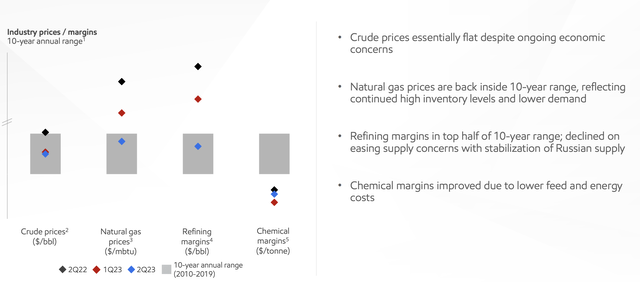

At the end of the day, Exxon Mobil's ability to survive depends on the pricing situation in its industry.

ExxonMobil Investor Presentation

As can be seen, margins in the most recent quarter have dropped down substantially. Crude oil prices remains roughly in the range of where it was last quarter, within the 10-year range from 2010-2019. The margins are down from where they will a year ago, shortly after Russia's invasion of Ukraine. Refining margins and natural gas margins went back into the 10-year range.

Chemical margins remain low, below the 10-year range, and in line with the weakness that has been seen for some time. This return to normalcy for margins pushes the company to double-digit margins,

Exxon Mobil Earnings

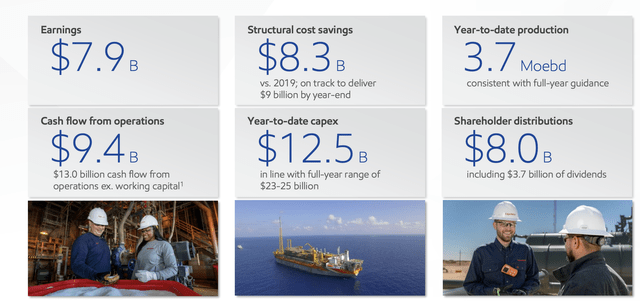

The company's earnings are just under $8 billion for the quarter, annualized at $32 billion, or a P/E of roughly 13. Historically that's expensive.

ExxonMobil Investor Presentation

The company earned $13 billion in CFFO excluding working capital, but due to one-time numbers, the company's number was $9.4 billion. The company's quarterly capex is roughly $6.5 billion meaning, even in a normal environment, annualized free cash flow ("FCF") is $24 billion. That gives the company a FCF yield of ~6%.

The company paid out $8 billion in shareholder distributions, with $3.7 billion in dividends. The company's annualized yield is ~8% for shareholder returns here, but that pushes the company's FCF into the negative. That means the company will struggle to continue providing the double-digit shareholder returns we expect and want.

Exxon Mobil Outlook

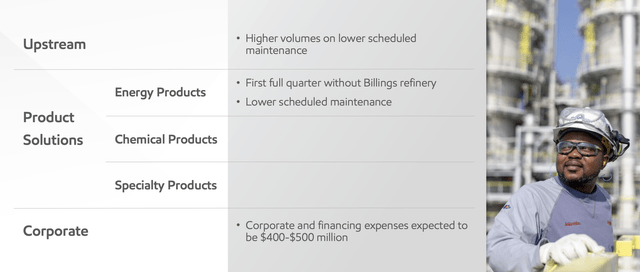

The company's outlook is promising but also has some downside that will potentially impact FCF.

ExxonMobil Investor Presentation

The company expects maintenance to decrease, which will temporarily help volumes. However, that's also the company's first quarter without the Billings refinery, which will hurt margins and earnings. The company's outlook will not have the tax event that temporarily hurt CFFO, but we expect the company's FCF and cash flow to remain lower versus its market cap.

Prices have been stronger recently, however, we don't see any sign that they will recover to the levels of strength seen with Russia's invasion of Ukraine.

Our View

Exxon Mobil is expensive.

The company has a market capitalization of just over $420 billion. The company has seen its margins recover back to historic levels, especially refining margins, which have been a source of strong profits for numerous companies recently. The company, with an integrated portfolio of assets, performs especially well in situations like this, but that situation is going.

Going forward the company is trading at a mid-to-high single digit FCF yield. We expect it to pass all of that FCF to shareholders effectively, as its debt is incredibly manageable. However, even then, at that FCF, the company isn't worth investing in. At its current market capitalization, it needs much higher FCF to justify its valuation.

That's especially true in a higher yield environment.

Thesis Risk

Brent crude prices have increased recently to almost $85 / barrel. Exxon Mobil has an impressive portfolio of low-cost production and its highly profitable. At higher prices, it's a cash flow machine. That could enable strong shareholder returns that justify the company's valuation, making it a valuable investment for those who invest now.

Conclusion

Exxon Mobil is a great company. The company has lowered its costs dramatically, enabling its margins to grow. As a result, the company's margins are much stronger versus its prior positioning at lower prices. The company's FCF remains in the high single-digits and the company has the debt yield to direct that towards shareholder returns.

The company's ability to justify its valuation depends on, not just its operations, but prices remaining higher. The company can't control that. Without black swan events like the Russia-Ukraine War, we don't see the company as having the FCF to justifying investing.

We look for companies that can provide double-digit long-term returns (the benefit of picking individual stocks is lost of you can't outperform the S&P 500). Given that Exxon Mobil doesn't mean that threshold, at the current time we recommend against investment.

https://news.google.com/rss/articles/CBMie2h0dHBzOi8vc2Vla2luZ2FscGhhLmNvbS9hcnRpY2xlLzQ2MjIxMTktZXh4b24tbW9iaWwtcmVtYWlucy1leHBlbnNpdmUtYXMtbWFyZ2lucy1yZXR1cm4tdG8tbm9ybWFsP3NvdXJjZT1mZWVkX2FsbF9hcnRpY2xlc9IBAA?oc=5

2023-08-01 13:00:21Z

CBMie2h0dHBzOi8vc2Vla2luZ2FscGhhLmNvbS9hcnRpY2xlLzQ2MjIxMTktZXh4b24tbW9iaWwtcmVtYWlucy1leHBlbnNpdmUtYXMtbWFyZ2lucy1yZXR1cm4tdG8tbm9ybWFsP3NvdXJjZT1mZWVkX2FsbF9hcnRpY2xlc9IBAA

Bagikan Berita Ini

0 Response to "Exxon Mobil Remains Expensive As Margins Return To Normal (NYSE:XOM) - Seeking Alpha"

Post a Comment