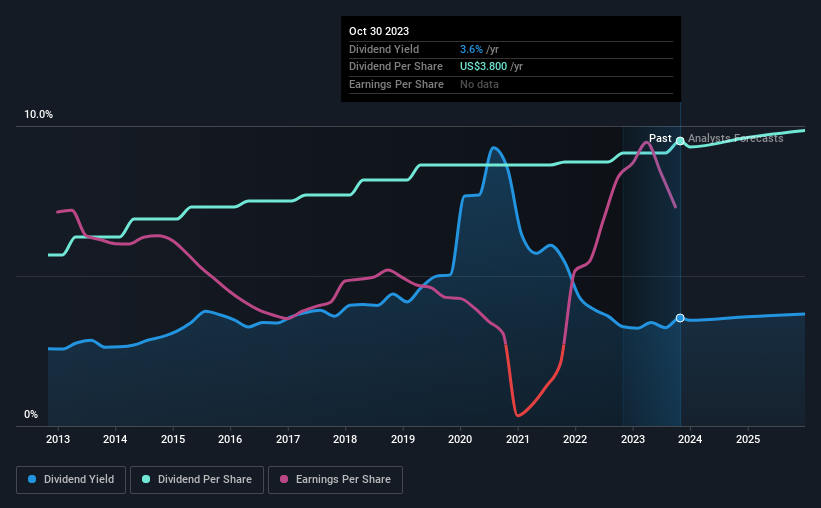

The board of Exxon Mobil Corporation (NYSE:XOM) has announced that it will be paying its dividend of $0.95 on the 11th of December, an increased payment from last year's comparable dividend. The payment will take the dividend yield to 3.6%, which is in line with the average for the industry.

View our latest analysis for Exxon Mobil

Exxon Mobil's Earnings Easily Cover The Distributions

We like a dividend to be consistent over the long term, so checking whether it is sustainable is important. However, prior to this announcement, Exxon Mobil's dividend was comfortably covered by both cash flow and earnings. As a result, a large proportion of what it earned was being reinvested back into the business.

Over the next year, EPS is forecast to fall by 8.0%. Assuming the dividend continues along recent trends, we believe the payout ratio could be 40%, which we are pretty comfortable with and we think is feasible on an earnings basis.

Exxon Mobil Has A Solid Track Record

Even over a long history of paying dividends, the company's distributions have been remarkably stable. Since 2013, the dividend has gone from $2.28 total annually to $3.80. This means that it has been growing its distributions at 5.2% per annum over that time. Companies like this can be very valuable over the long term, if the decent rate of growth can be maintained.

The Dividend Looks Likely To Grow

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Exxon Mobil has impressed us by growing EPS at 14% per year over the past five years. Growth in EPS bodes well for the dividend, as does the low payout ratio that the company is currently reporting.

We Really Like Exxon Mobil's Dividend

In summary, it is always positive to see the dividend being increased, and we are particularly pleased with its overall sustainability. The company is generating plenty of cash, and the earnings also quite easily cover the distributions. However, it is worth noting that the earnings are expected to fall over the next year, which may not change the long term outlook, but could affect the dividend payment in the next 12 months. All in all, this checks a lot of the boxes we look for when choosing an income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For instance, we've picked out 1 warning sign for Exxon Mobil that investors should take into consideration. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Valuation is complex, but we're helping make it simple.

Find out whether Exxon Mobil is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

https://news.google.com/rss/articles/CBMifWh0dHBzOi8vc2ltcGx5d2FsbC5zdC9zdG9ja3MvdXMvZW5lcmd5L255c2UteG9tL2V4eG9uLW1vYmlsL25ld3MvZXh4b24tbW9iaWwtbnlzZXhvbS1pcy1wYXlpbmctb3V0LWEtbGFyZ2VyLWRpdmlkZW5kLXRoYW4tbGFz0gGBAWh0dHBzOi8vc2ltcGx5d2FsbC5zdC9zdG9ja3MvdXMvZW5lcmd5L255c2UteG9tL2V4eG9uLW1vYmlsL25ld3MvZXh4b24tbW9iaWwtbnlzZXhvbS1pcy1wYXlpbmctb3V0LWEtbGFyZ2VyLWRpdmlkZW5kLXRoYW4tbGFzL2FtcA?oc=5

2023-10-30 10:13:25Z

CBMifWh0dHBzOi8vc2ltcGx5d2FsbC5zdC9zdG9ja3MvdXMvZW5lcmd5L255c2UteG9tL2V4eG9uLW1vYmlsL25ld3MvZXh4b24tbW9iaWwtbnlzZXhvbS1pcy1wYXlpbmctb3V0LWEtbGFyZ2VyLWRpdmlkZW5kLXRoYW4tbGFz0gGBAWh0dHBzOi8vc2ltcGx5d2FsbC5zdC9zdG9ja3MvdXMvZW5lcmd5L255c2UteG9tL2V4eG9uLW1vYmlsL25ld3MvZXh4b24tbW9iaWwtbnlzZXhvbS1pcy1wYXlpbmctb3V0LWEtbGFyZ2VyLWRpdmlkZW5kLXRoYW4tbGFzL2FtcA

Bagikan Berita Ini

0 Response to "Exxon Mobil (NYSE:XOM) Is Paying Out A Larger Dividend Than Last Year - Simply Wall St"

Post a Comment