What defines Tesla (NASDAQ:TSLA)? This question has surfaced repeatedly, and the answer isn’t as straightforward as it may seem. While Tesla does manufacture cars, it stands out for one unique selling point: it produces electric vehicles and it is undoubtedly a pioneer and leader in that field. Nevertheless, Tesla’s valuation diverges significantly from that of its automotive peers, primarily because it is commonly perceived as a tech company and therefore valued accordingly.

The company also sees itself as more than a car maker, or as HSBC analyst Michael Tyndall says, Tesla has “positioned itself as an innovator.”

“Cars may well be the main driver of revenue and profits currently, but if the group is to be taken at its word, the future for Tesla is about robots, autonomous vehicles, energy storage, and super-computers,” Tyndall goes on to say. “Many of these ideas are in the concept stage at present, which makes modeling them and valuing them problematic.”

After speaking with various colleagues whose expertise lies in those other segments Tesla has set its sights on penetrating, it is clear to Tyndall that there is a “fair degree of hope in the current share price.”

“Ironically,” Tyndall adds, “the better Tesla is as an auto company, the more it deserves an ‘auto-like’ valuation, so arguably the ideas need to become reality to support the current share price.”

That’s not to say Tesla won’t come good on its ambitious plans. One of those involves the grand target of delivering 20 million units by 2030. You can scoff if you like, but Tesla has a “track record of generally doing what it promises.”

It’s also worth remembering that Tesla’s ideas and ambitions on which its lofty valuation rests reflect those of its outspoken CEO Elon Musk. Musk’s personality and fame have helped the company gain exposure but at the same time, his prominence presents a “considerable ‘single-man’ risk at the group.”

As someone looking in from the outside, Tyndall makes the case that Musk’s outlandish ideas could well become a reality, so it’s best not to judge. However, as far as Tyndall is concerned, his caution is down to the “uncertainty around the timing and commercialization of its varied ideas.”

“We see considerable potential in Tesla’s prospects and ideas,” the analyst summed up, “but we think the timeline is likely to be longer than the market and valuation are reflecting.”

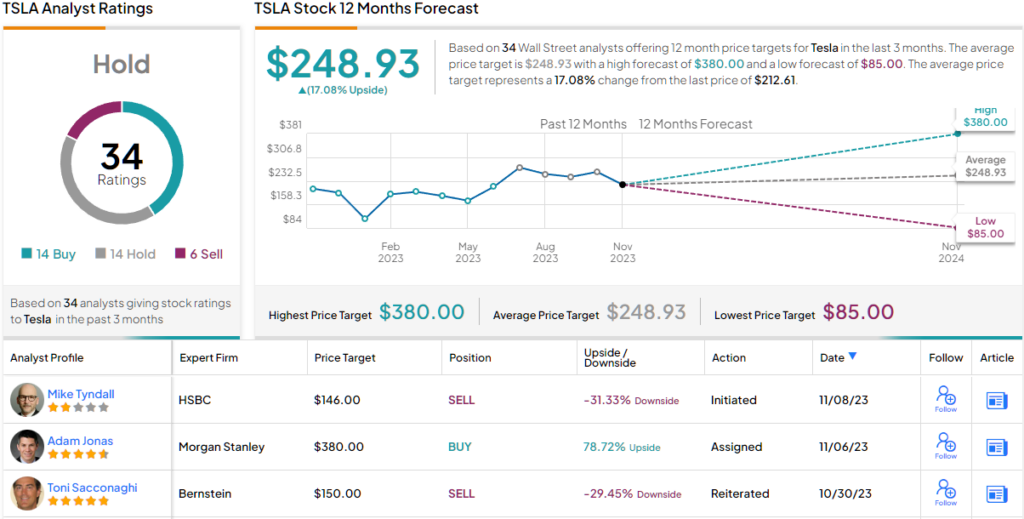

As such, Tyndall initiated coverage of Tesla with a Reduce (i.e., Sell) rating and $146 price target, suggesting shares will see downside of 31% in the months ahead. (To watch Tyndall’s track record, click here)

Looking at the consensus breakdown, 5 other analysts join Tyndall in the bear camp and with an additional 14 Buys and Holds, each, the stock claims a Hold consensus rating. The average target currently stands at $248.93, implying shares will gain 17% over the coming year. (See Tesla stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Read Again https://news.google.com/rss/articles/CBMiV2h0dHBzOi8vd3d3LnRpcHJhbmtzLmNvbS9uZXdzL2FydGljbGUvdGVzbGEtc3RvY2stdGhlLXN0YWtlcy1zZWVtLXRvby1oaWdoLXNheXMtYW5hbHlzdNIBAA?oc=5Bagikan Berita Ini

0 Response to "Tesla Stock: The Stakes Seem Too High, Says Analyst - TipRanks.com - TipRanks"

Post a Comment