Joe Raedle

Intro & Thesis

I remember very well the saying that you shouldn't try to time the market. But that's basically the bread and butter of Wall Street analysts because even if they don't try to predict the exact high or low of a stock, their calls to buy or sell in a certain way always have to do with timing.

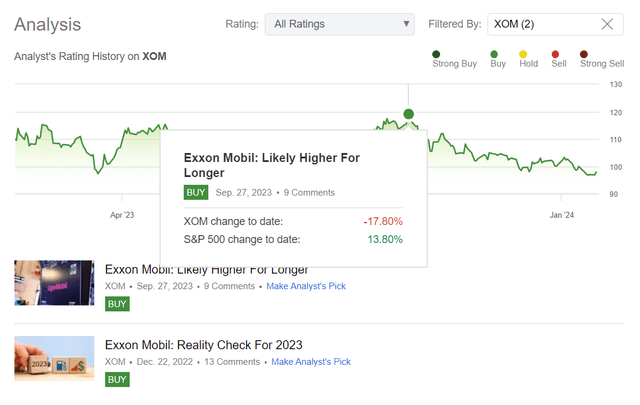

My bullish calls on Exxon Mobil Corporation (NYSE:XOM) stock, of which there were only 2, had terrible timing - especially my second article from September 27, 2023, which underperformed the broad market by a very wide margin:

Seeking Alpha, my coverage of Exxon Mobil

However, I believe that now is the best time to double down on my call - in today's article I will try to explain my thesis through the prism of the sector as well as XOM's specific prerequisites for the publication of strong Q4 results (expected February 2, 2024).

Why Do I Think So?

From what I read in different oil and gas outlooks, the integrated oil and gas industry seems to be in solid shape to date and may be poised for a significant upswing in the coming year for several compelling reasons.

First off, the sector benefits from disciplined supply-side measures, with key oil-producing nations implementing strategic cuts to counter potential demand weaknesses. This commitment to balancing supply and demand dynamics is expected to create a favorable pricing environment. Additionally, the anticipated average price of WTI crude hovering around $90 per barrel for the year further underscores the positive trajectory, offering enhanced profitability for integrated oil companies operating both upstream and downstream.

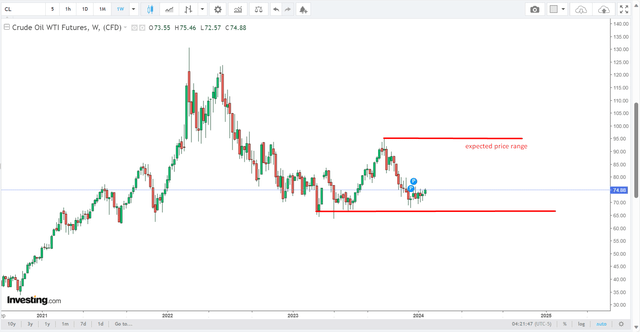

Investing.com, author's notes

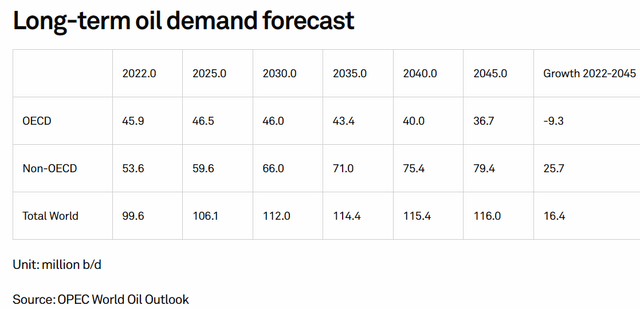

On the demand side, the industry stands to gain from a resurgence in crude oil consumption, which has rebounded to pre-pandemic levels. Robust refinery utilization at ~92% and inventory levels of crude oil and gasoline below their five-year averages indicate solid demand fundamentals. Despite potential headwinds, such as a possible recession in China, the peak crude oil demand has not yet been reached, judging by the OPEC World Oil Outlook:

S&P Global, Commodities Insights

This, coupled with efficiency gains and the ongoing integration of renewable energy sources, contributes to the positive industry outlook, in my view.

Lastly, downstream operations within the integrated oil and gas sector are expected to play a pivotal role in the industry's surge. While facing challenges last year, the downstream segment has demonstrated resilience, with refineries operating at 90%-95% capacity. This has positively impacted margins, and the downstream sector's concentration among a few major suppliers has contributed to sustained high pricing.

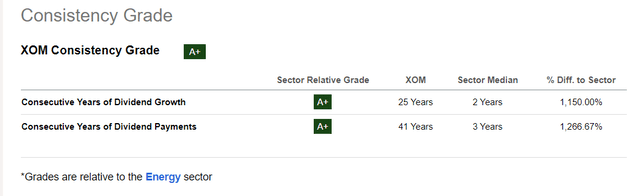

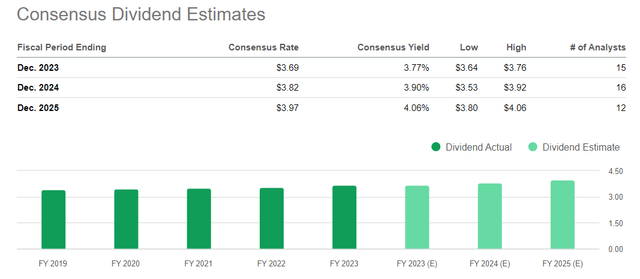

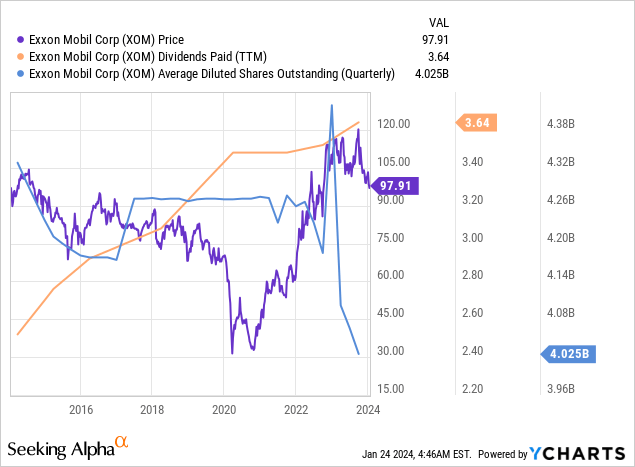

Against this positive industry backdrop, ExxonMobil stands out as one of the top choices among integrated oil and gas companies, primarily due to its resilient performance during the collapse in oil prices, maintaining its dividend throughout.

Seeking Alpha, XOM's dividend history

The company leads the sector with a robust list of organic growth opportunities, further accelerated by the pending acquisition of Pioneer Natural Resources (PXD). This strategic move is expected to trigger a substantial inflection in cash flow, more than doubling compared to pre-COVID levels by 2027, according to BofA's analysts' estimates (proprietary source). The projected free cash flow outlook, encompassing both organic growth and contributions from Pioneer Natural Resources post-acquisition, is anticipated to fully cover ExxonMobil's next-year dividend, which is close to ~4% considering the latest correction.

Seeking Alpha, XOM's dividend estimates

Amid stabilized refining tailwinds, XOM is set to initiate multiple projects within its product solutions portfolio, driving mid-cycle EBITDA higher toward its $10 billion target by FY2027. The company's ability to balance short-cycle and long-cycle growth, particularly secured during economic downturns, distinguishes it in the industry. This balance positions ExxonMobil to generate outsized cash returns and foster per-share dividend growth, in my view.

With buybacks having been reset 3 times and a current run rate of ~$20 billion annually, the company is poised to support unit dividend growth of around 4%, maintaining absolute payout levels while having significant capacity to resume dividend growth at above-average rates.

So I think this capacity, coupled with associated share price support, makes ExxonMobil an attractive choice for investors seeking stability, growth, and dividends in the integrated oil and gas sector.

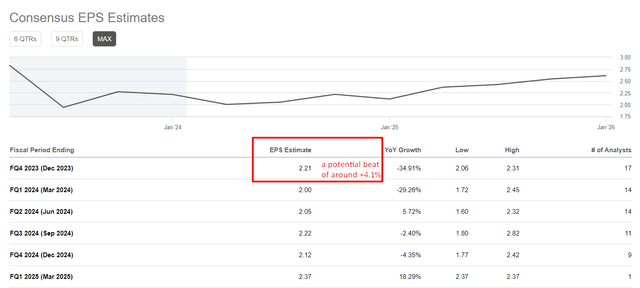

In the short term, and irrespective of the long-term bias, I consider XOM to be a solid 'Buy' before the earnings release. Why?

On January 4, after the market closed, XOM released an 8-K with 4Q earnings considerations. It expects $2.4B-$2.6B in Q4 impairments related to its upstream business, mostly related to idled assets in California, and said changes in oil prices would knock $400-$800 million from upstream earnings in the quarter compared with Q3's $6.1 billion. At first glance, this news sounds negative - and that is exactly how the market perceived it, as XOM’s stock price fell further after the announcement:

![Seeking Alpha News [January 5, 2024]](https://static.seekingalpha.com/uploads/2024/1/24/49513514-17060916781448696.png)

Seeking Alpha News [January 5, 2024]

However, JPM analysts were quick to estimate (proprietary source) that implied earnings per share would be ~$2.3, which is ~4.1% above current consensus expectations:

Seeking Alpha, author's notes

Goldman Sachs (proprietary source) also shared their thoughts on where implied EPS will end up. Their forecast is somewhat more modest, but still points to an earnings beat for Q4:

![Goldman Sachs [proprietary source]](https://static.seekingalpha.com/uploads/2024/1/24/49513514-17060921051654716.png)

Goldman Sachs [proprietary source]

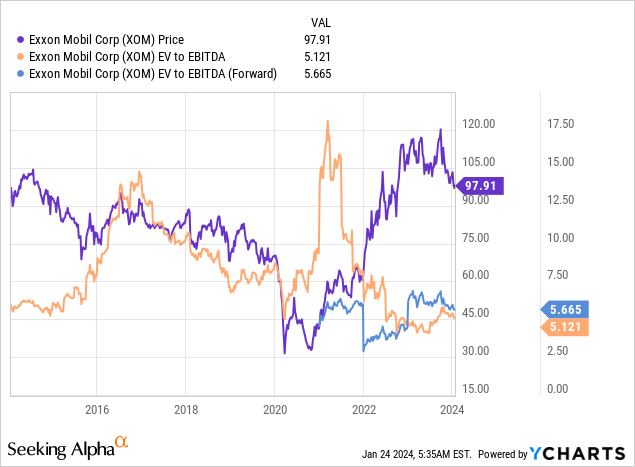

Furthermore, I think the current valuation of the company creates some sort of headroom for growth after earnings. XOM is trading at the lowest EV/EBITDA levels (both TTM and FWD) in the last 10 years, which makes the company very cheap given the relative stability of its EBITDA margins and prospects for production expansion.

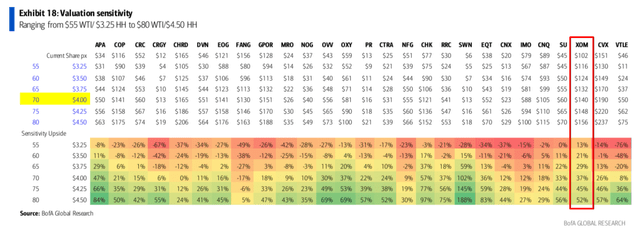

Of course, geopolitical factors and future oil prices play a role in putting pressure on the company's valuation. But even from the point of view of a fundamental valuation recently carried out by BofA analysts, XOM proved to be the company least sensitive to the volatility of crude oil prices, confirming once again the advantage of its scale.

BofA, author's notes

At an oil price of $70, BofA sees XOM's fair value at $140 per share. The CFRA analysts [proprietary source] expect a somewhat more modest upside potential of ~23.6%, while Goldman Sachs sees an upside potential of only 16.4%. Looking at the current EV/EBITDA, I agree that with a potential EBITDA of $73.92 billion next year (the consensus view, based on YCharts data), the stock should rise from here. If the valuation multiple rises to 7x, which is fine for XOM based on its history, then the company's market capitalization should be ~$476.2 billion after adjusting for net debt. That is ~21.4% more than the current market cap.

Risk Factors To Keep In Mind

An investment in ExxonMobil involves various risks related to the nature of the commodities business and the company's global activities. One major challenge is the limited control over product prices, as the company is dependent on volatile commodities market. Exxon also operates in regions where there has been corruption and political upheaval in the past, which brings with it geopolitical risks. However, the company's broad geographical presence helps to mitigate the impact of the risks associated with individual countries.

Transaction risks are relevant due to the acquisitions of Pioneer and Denbury by XOM. Also, XOM's major ongoing capital projects could experience delays or budget overruns, which could weigh on the stock. If the company continues its acquisition strategy, integration risks could also arise.

So investors should keep the uncertainties associated with commodity markets, potential operational challenges and geopolitical factors in mind before buying XOM or especially doubling down as my title suggests.

The Bottom Line

The picture that is emerging for Exxon Mobil and other western O&G giants is quite unusual. As recently as October, their stock prices were reaching multi-year highs, but in the following two months they lost all of their 2023 growth.

Despite the potential risks surrounding XOM, I view the company and the sector as a whole with a positive outlook for 2024. The company continues to benefit strongly from relatively stable energy prices and current valuation multiples seem to completely discount the potential continuation of the above-average FCF generation of recent years. I think XOM will maintain its status as the O&G dividend king for years to come. In the near term, XOM's upcoming report should easily exceed expectations based on the implications from the recent 8-K filing.

Therefore, I think the idea of increasing the position in XOM ahead of the Q4 report is a justifiable investment decision.

Thanks for reading!

https://news.google.com/rss/articles/CBMiSGh0dHBzOi8vc2Vla2luZ2FscGhhLmNvbS9hcnRpY2xlLzQ2NjQ5MDUtZXh4b24tbW9iaWwtdGltZS10by1kb3VibGUtZG93btIBAA?oc=5

2024-01-25 12:24:08Z

CBMiSGh0dHBzOi8vc2Vla2luZ2FscGhhLmNvbS9hcnRpY2xlLzQ2NjQ5MDUtZXh4b24tbW9iaWwtdGltZS10by1kb3VibGUtZG93btIBAA

Bagikan Berita Ini

0 Response to "Exxon Mobil Stock: Time To Double Down (NYSE:XOM) - Seeking Alpha"

Post a Comment