jetcityimage

There Will Be Blood

If you have not seen the movie "There Will Be Blood" I highly recommend it! It's a fantastic movie. The movie portrays quite well the harsh cutthroat nature of the oil and gas business. Another very enlightening and funny example of what it's like in the oil and gas business is this Saturday Night Live Skit, "Career Day."

Let me start by saying I have lived in San Antonio, Texas, since I was 5 years old. I have several friends who have been involved in the oil and gas exploration and production business for over 3 decades. I am a former FINRA registered securities broker who sold limited liability partnership units in oil and gas ventures to accredited investors in a past life as well.

Exxon Mobil Corporation (NYSE:XOM) is my favorite oil major. It's known as the "Texas Oil Titan" to those of us who reside in the Lone Star State. I have been investing in Exxon Mobil and oil stocks for decades. The one constant has been that the oil and gas industry is cyclical in nature. Furthermore, at certain points in the cycle, investors become starry eyed at the peaks in the cycle and overly pessimistic at the troughs. In my latest piece, I stated Exxon Mobil's stock looked like it was about to roll over and a significant downside move was in the cards.

Exxon Mobil Chart 2/24/23

Finviz

In fact, that is exactly what happened. Exxon's stock has fallen approximately 13% over the past month.

Exxon Mobil Current Chart

Finviz

In the previous article, I stated:

"Something has got to give in regards to the 20% spread between oil's current price and Exxon Mobil's stock price. After reviewing the data, it appears Exxon's stock is most likely going to drop substantially to meet oil's price rather than vice versa. It is not out of the question that Exxon's stock price will revisit the October 2022 lows if a recession takes hold."

Well, it appears the scenario is currently playing out exactly as I surmised.

WTI / XOM Comparison

Oil has fallen 13% over the past month. Exxon Mobil's stock has fallen right along with it. Check out the comparison chart below.

CNBC

Over the past month, Exxon Mobil's stock has once again regained its correlation to oil's price. With the current global banking turmoil taking hold, I do not see a reversal in oil and gas prices or Exxon's stock price anytime soon. In fact, I would not be surprised if we see Exxon's stock price drop another 17% and retest the October low of $83. This is due to the fact the bank failures are only the tip of the iceberg when it comes to the bad news on the horizon for the economy.

Systemic banking issues often lead to a "credit crunch" which greatly impacts the growth prospects for the economy. This directly effects oil and gas names due to the fact demand is bound to drop. In fact, Goldman Sachs just cut its GDP forecast due to the increased stress put on small banks recently.

What's more, I believe Exxon's stock has increased downside risk, as it is still trading at a premium to its peers and historical average. This is due to the fact everyone and their brother has piled into the stock. For the past year, many have been touting the energy sector is the place to be, and most still are as a matter of fact. The issue is all the good news gets priced in at some point. Moreover, eventually there is no one left to buy once everyone's already in. When this happens, the stock begins to roll over and takes a nose dive. As a matter of fact, the Seeking Alpha Quantitative Analysis rating has just recently changed to a hold.

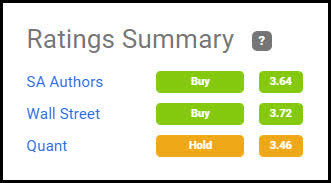

Seeking Alpha Rating Summary

Seeking Alpha

While Seeking Alpha authors and Wall Street analysts remain bullish on Exxon with Buy ratings, the unbiased Seeking Alpha Quant rating is Hold.

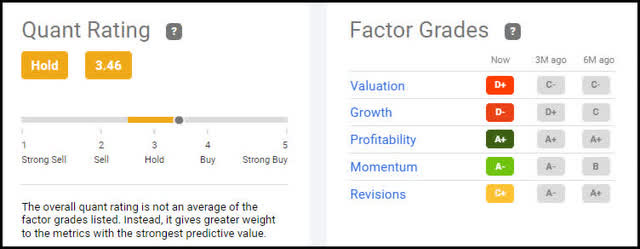

Exxon Mobil SA Quant Rating

Seeking Alpha

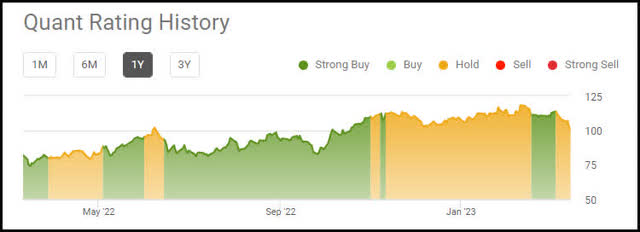

The Quant rating just recently changed from a buy to hold - at about the exact same time I wrote my previous article.

Exxon Mobil Quant Ratings History

Seeking Alpha

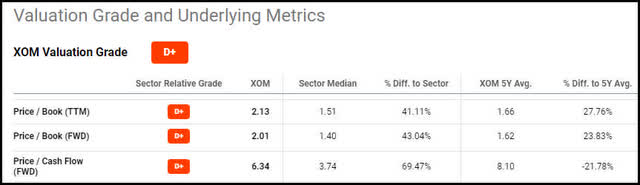

The reasons Quant rating changed to a Hold are related to Exxon's valuation and growth metrics.

Seeking Alpha Quant Valuation Metrics

Seeking Alpha

Even though some tout Exxon Mobil as still currently undervalued, when digging deeper into the numbers, it doesn't appear that way. Exxon is trading for a substantial premium to its peers and its 5-year average on its price/book and forward cash flow metrics. Exxon Mobil's growth metrics are lagging as well.

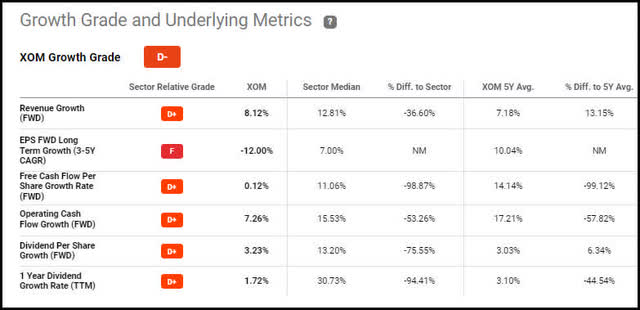

Seeking Alpha Quant Growth Metrics

Seeking Alpha

The same goes for Exxon's growth metrics. While many tout the extraordinary growth prospects for Exxon Mobil, when reviewing the actual statistics, Exxon's growth prospects are lagging in several key categories by a wide margin. Now let's get to the most important part of the Buy decision, the dividend.

Exxon Mobil Dividend Analysis

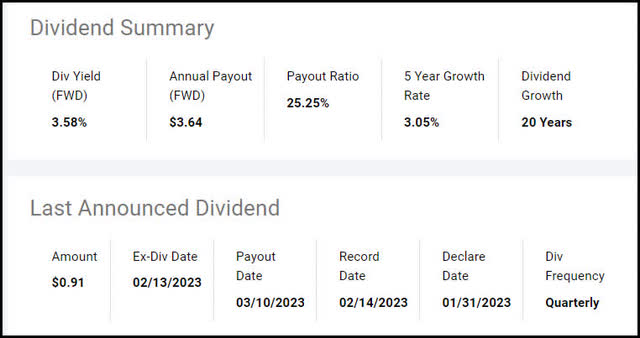

The primary reason most buy Exxon Mobil stock is for the dividend income.

Exxon Mobil Dividend Summary

Seeking Alpha

Presently, the dividend yield is an anemic 3.58%. I was expecting management to raise the dividend substantially last quarter, yet they decided to return capital to shareholders in the form of billions of dollars in stock buybacks instead. With the yield so low and a payout ratio of 25%, I am hoping they raise the dividend substantially at the next earnings announcement. Yet, I'm not holding my breath. I am up severalfold regarding my Exxon Mobil buys and sells over the years. At this point in time, I use the dividend yield as my primary factor when deciding whether to buy back in or not. I need to see the yield at 5% or better at this point. That would put the share price at $73. I am sure that price point seems like an impossible dream to most based on the way the stock has been trading over the past two years.

Current Long-Term Chart

Finviz

Nevertheless, as a matter of fact XOM stock was traded in the $70 to $80 range for quite some time prior to the 2020 COVID crash. Keep in mind, this was during a time when the economy was firing on all cylinders as well. The 200-month SMA is $79. With the way things are headed, not just for the U.S. economy but global economy as well, I can easily see Exxon Mobil's stock price falling back to the $75 range over the next year. I believe a credit crunch will cause a global recession to take hold and Exxon Mobil stock price will not be spared as many seem to believe. Now let's wrap this up.

The Wrap Up

I am going to start with my disclaimer. I am not an investment advisor. I am not advocating anyone buy or sell Exxon Mobil's stock. I am simply laying out my thoughts for you to consider. If you are a long-term shareholder and have a solid yield locked in, that is great. I am not saying you should sell out. In fact, when I am in those situations, I often employ a covered call options strategy. This can serve to enhance the yield and protect the portfolio. I am not looking to buy back in until the yield is in the 5% range.

I believe we are just at the beginning of what will most likely turn into a recession. Based on the latest bank implosions, I'd say the odds of a soft landing are off the table as well. This does not bode well for oil prices and, therefore, Exxon's stock price either. Exacerbating the situation is the fact that so many have loaded up on Exxon Mobil in particular and energy stocks in general. Exxon's stock is still trading at a premium while several other energy stocks have taken huge hits already. There are better opportunities in the oil and gas sector at this time than Exxon Mobil.

I believe Exxon's stock will most likely take another leg lower when earnings are announced on 4/28/23. I can't see how they will give strong guidance based on the current macro outlook. I expect them to be conservative as they usually are. If they don't raise the dividend, the stock could take a substantial drop if it hasn't already by then. 4/28 is a long ways off in this environment. Those are my thoughts on the matter. I look forward to reading yours.

https://news.google.com/rss/articles/CBMiSGh0dHBzOi8vc2Vla2luZ2FscGhhLmNvbS9hcnRpY2xlLzQ1ODgwODktZXh4b24tbW9iaWwtdGhlcmUtd2lsbC1iZS1ibG9vZNIBAA?oc=5

2023-03-17 12:00:00Z

CBMiSGh0dHBzOi8vc2Vla2luZ2FscGhhLmNvbS9hcnRpY2xlLzQ1ODgwODktZXh4b24tbW9iaWwtdGhlcmUtd2lsbC1iZS1ibG9vZNIBAA

Bagikan Berita Ini

0 Response to "Exxon Mobil Stock: There Will Be Blood (NYSE:XOM) - Seeking Alpha"

Post a Comment